South Africa Requests Feedback For Private Investment In Passenger Rail

FreeThe government is looking to expand regional rail systems and develop high-speed travel.

South Africa’s Department of Transport (DoT) has invited responses by 15 December to a series of requests for information (RfI) that will be used to guide the state-owned Passenger Rail Agency of South Africa (PRASA) in developing private sector participation (PSP) projects for passenger rail infrastructure and operations.

According to the RfI, persistent challenges have undermined PRASA’s ability to consistently deliver on its mandate, particularly due to infrastructure deterioration, operational inefficiencies and governance shortcomings.

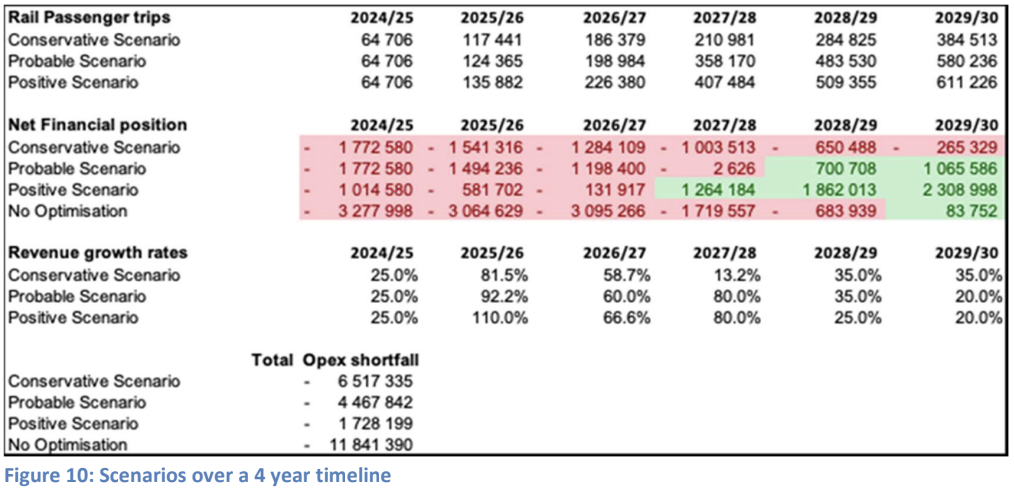

Notwithstanding these constraints, the entity is currently undergoing a steady recovery in operations, with more than Rand 27 billion (US$1.5 billion) invested in capital projects over the past 18 months, approximately 80% of operational corridors restored and passenger volumes already exceeding 50 million for the current financial year. Minister of Transport Barbara Creecy has committed to expanding annual passenger trips to 600 million by 2030.

However, significant challenges remain for PRASA, slowing its pace of recovery, which is occurring in a fiscally constrained environment, thus necessitating the exploration of alternative and innovative funding sources.

Participation in the RfI process is expected to assist PRASA in gathering information, innovative ideas and solutions that will guide future requests for proposals (RfP) for private sector investment in the passenger rail sector.

PSP has been identified as a transformative lever capable of shifting South Africa’s rail system from its current fragmented and underperforming state – characterised by informal taxi dominance and weak rail consolidation – towards a modern, integrated and reliable rail-led mobility framework. PSP is seen as more than a financing tool in that it can introduce operational discipline, reliability and efficiency essential for a system-wide revitalisation.

The outcomes expected from the PSP for the passenger rail projects are:

- Enhancing rail reliability and attractiveness, encouraging appropriate modal use of cars, taxis, buses and trains;

- Unlocking land value around transit nodes, fostering sustainable urban and regional development;

- Promoting regional economic integration through improved connectivity across metropolitan, provincial and cross-border corridors;

- Aligning financing and operational incentives to ensure sustainable, scalable service delivery;

- Leveraging industrial capacity to support domestic and continental rail market growth.

The DoT is aiming to modernise PRASA to provide reliable commuter rail services, serving as a strong anchor for suburban transit-oriented development (TOD). Furthermore, expanding regional rail extensions such as those from Gauteng to Polokwane, Musina and Mbombela would promote regional consolidation and TOD integration.

The future development of high-speed rail (HSR) lines, including routes between densely populated cities (>5 million residents) such as Johannesburg, Durban and Cape Town, with Aerotropolis (airport city) integration, aims to unlock mega-hub TOD opportunities. Learning from Gauteng’s expansion of the Gautrain through the Rapid Rail Integrated Network, the DoT plans to bring regional rapid transit (RRT) to other provinces. This is expected to initially steer new economic hubs north of Gauteng toward Polokwane and Musina, eastward to Mbombela and Komatipoort, and HSR southwards between Johannesburg and Durban – turning transport corridors into corridors of opportunity.

The DoT has released five RfIs, which are detailed below:

RfI 1 – PRASA Automatic Fare Collection System:

This initiative aims to implement a unified, account-based fare system integrated with mobility as a service (MaaS). The goal is seamless travel across modes and stronger, more transparent revenue management.

RfI 2 – Modernisation of PRASA’s Depots at Wolmerton and Braamfontein:

This project looks to modernise and concession key maintenance depots at Braamfontein and Wolmerton to raise operational reliability. This includes redeveloping adjoining land for TOD and logistics use, turning depots into anchors for urban renewal.

The Braamfontein depot in Johannesburg and the Wolmerton depot in Pretoria are seen as pivotal assets in South Africa’s rail network as they house, service and maintain rolling stock, forming the backbone of operational reliability and workforce productivity. Efficient depot management will keep the fleet running safely and on time. The PSP investment will follow the design, build, finance and maintain (DBFM) model in which private partners modernise facilities and oversee performance under long-term concession agreements.

According to the RfI, the land surrounding the depots holds value beyond maintenance as it can anchor TODs and logistics parks, linking depots with commercial and housing projects that create new revenue streams. At Braamfontein, roughly 58 hectares of prime land in the Johannesburg central business district (CBD) is estimated to offer exceptional potential for land value capture, primarily through the development of air rights above the yard – far larger than the adjacent 13-hectare Park Station site.

RfI 3 – Commercialisation of the PRASA Digital Infrastructure/Fibre-Optic Network:

The plan is to commercialise PRASA’s dormant fibre-optic network to earn steady non-fare revenue. These proceeds will be reinvested in digital systems that improve safety, communications and operational efficiency. The project could potentially include the PRASA-owned radio spectrum to achieve blended infrastructure commercialisation.

RfI 4 – Rolling Stock Leasing and Manufacturing:

The DoT is looking to lease and operate the new PRASA electric multiple unit (EMU) Blue Fleet trains under performance-based contracts to modernise urban commuter services, improve reliability and use capacity more efficiently. It is also aiming to expand the Gibela factory as a regional hub for rolling stock manufacturing and export within the African Continental Free Trade Area (AfCFTA) framework, supporting future RRT and HSR projects. The ministry is also planning to repurpose the existing PRASA Yellow Fleet.

On expanding the Gibela manufacturing hub in Nigel, Gauteng province, the RfI states that the development is the largest rolling stock manufacturing facility in Africa and that the PSP seeks to expand the plant’s capacity and product range to serve both cape gauge (1,067mm) and standard-gauge (1,435mm) markets.

The expansion could be financed through a partnership between original equipment manufacturers (OEMs), development finance institutions (DFIs) and private equity investors, strengthening South Africa’s industrial base while creating jobs and technology transfer opportunities. Achieving regional economies of scale will lower fleet costs, enhance competitiveness and advance the 2015 African Union resolution designating South Africa as the continent’s rail industrialisation hub, the RfI notes.

RfI 5 – RRT and HSR:

The project targets the concessioning of strategic regional corridors such as Johannesburg-Polokwane-Musina and Johannesburg-Mbombela under design-build-operate-maintain (DBOM) models to strengthen regional links and unlock TOD opportunities at key stations. It also looks to facilitate the first HSR PSP between Johannesburg and Durban.

The vision is of a modernised PRASA delivering reliable commuter rail services that anchor suburban TOD, while new regional rail extensions to Polokwane, Musina, Mbombela and Pietermaritzburg will stimulate regional consolidation and integrated growth. Over time, these corridors are set to connect seamlessly with future HSR lines linking South Africa’s largest cities – Johannesburg, Durban and Cape Town – where Aerotropolis nodes such as the OR Tambo, King Shaka and Cape Town International airports become catalysts for mega-hub TODs and economic clustering.

Each RRT corridor could be structured as a route-specific concession under DBOM or similar long-term PSP models. Consortia will be responsible for financing, constructing and operating the infrastructure and rolling stock, while the state retains ownership of land, wayleaves and strategic oversight. Clear risk-sharing will ensure private partners manage performance, technology and operations, while public entities safeguard network access, affordability and safety.

The corridors are expected to achieve high passenger consolidation ratios reflecting strong regional demand and be aligned with the AfCFTA. This approach will promote standardised, cross-border PSP templates for Southern Africa’s rail corridors. By harmonising investment structures and technical standards across SADC, the RRT initiative is expected to encourage regional cooperation, industrial scaling and shared prosperity.

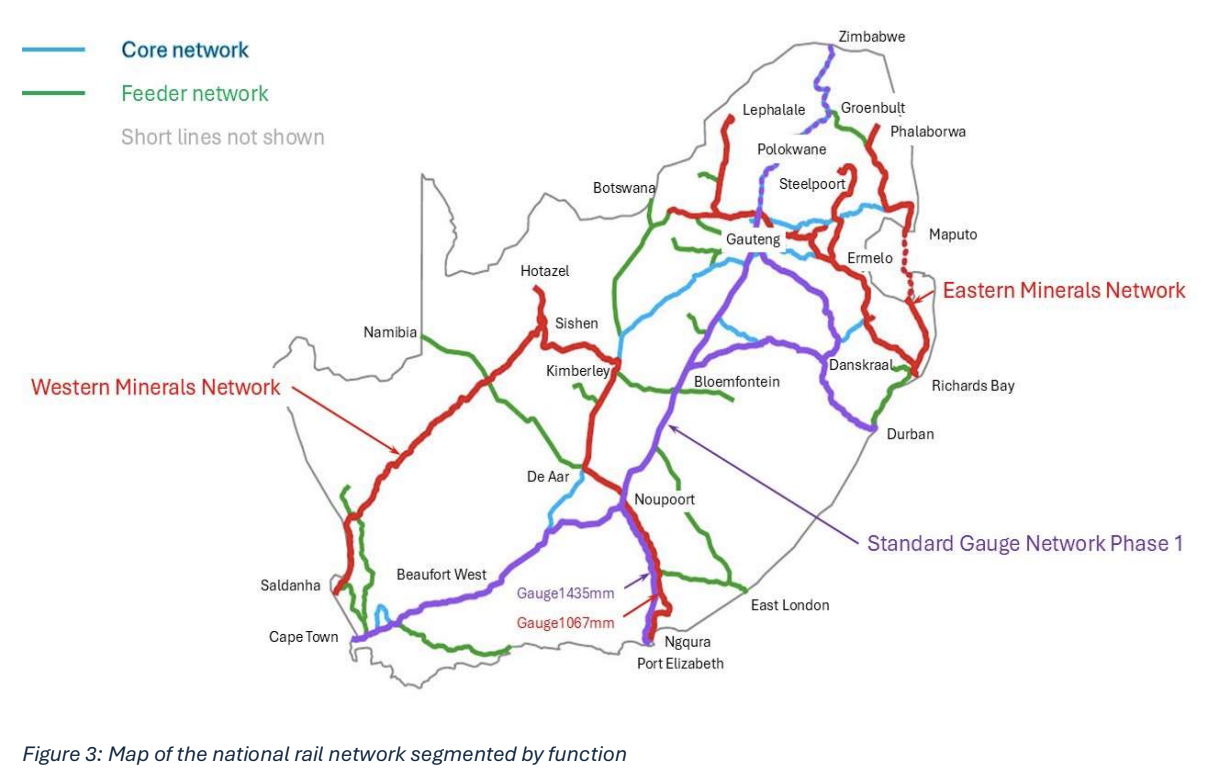

In the future, RRT services in South Africa are envisaged to be integrated with the new standard gauge national network, known as Phase 1, which is designed to enable rail to target South Africa's richest logistics corridors and will be configured primarily for dominant freight traffic (heavy intermodal), but will also support RRT services.

On the standard gauge routes, RRT services will be introduced at a maximum speed of 160-200km an hour (km/h), enabling a natural reach of approximately 450km in three hours. Hence, RRT is planned to connect areas such as Gauteng to provincial capitals – Bloemfontein, Kimberley and Mbombela (second HSR priority) and Polokwane (third HSR priority); as well as Newcastle to Durban and Gauteng; and Cape Town to Beaufort West.

The framework establishes foundations for broader network expansion, including potential extensions to Mbombela-Maputo, coastal corridors and integration with the African Continental High Speed Rail Network (AIHSRN) as economic conditions and technical capacity development permit.

“We’re planning a new generation of regional trains – faster, safer and more frequent – connecting cities like Pretoria, Johannesburg, Polokwane, Musina, Mbombela and Durban, using our existing network up to 120 kilometres per hour, building new 160 to 200 kilometres per hour regional lines, and testing the water for a new 300-kilometre-per-hour high-speed railway between Johannesburg and Durban,” said Minister Creecy during the launch of the RfIs in late October.

“These lines will shorten travel times, reduce travel costs, take pressure off our roads and stimulate new development in towns along each route. These regional projects are not possible without private sector partnership.”

The minister noted the DoT had concluded a memorandum of agreement with the Development Bank of Southern Africa (DBSA) and the National Treasury, appointing DBSA as the implementing agent on its behalf for the PSP Unit. The PSP Unit is in the process of being capacitated and will be ready to commence with the conceptualisation of bid windows and development of RFPs.

Update on Rail and Port Freight RfI

Minister Creecy also provided an update on the RfIs launched in late March for the Transnet rail and port freight logistics projects. At the request of private parties, the closing date of 12 May was extended to 31 May. In total, 162 companies and one sphere of government responded – 163 in total.

Transnet is expected to issue the first RfP before the end of 2025 and three more in the first half of 2026.

The freight RfIs covered three major corridor groupings:

1. Richards Bay Corridor (KwaZulu-Natal): Handling exports of coal from Limpopo and Mpumalanga, and chrome from the North West, as well as magnetite from Limpopo – 48 respondents;

2. Saldanha and Nelson Mandela Bay Corridors: Serving exports of iron ore and manganese from the Northern Cape through Saldanha, and manganese through Port Elizabeth and Ngqura – 46 respondents;

3. Intermodal Corridors: Covering container and automotive supply chains linking Gauteng to the ports of Durban, Port Elizabeth, Ngqura, East London and Cape Town – 52 respondents.

According to the DoT, a consistent message emerged from 95 respondents across 15 countries (with 76% based in South Africa) across all three RFIs, namely that the challenge lies in performance, not potential. The respondents opined that the country has the resources, infrastructure and investor appetite, and that it simply needs to make the system work. Investors are ready to contribute capital, technology and operational expertise, provided governance is credible, projects are ring-fenced and outcomes are measurable, the respondents noted.

The respondents called for:

- Operational reform before expansion – fix what exists first;

- Targeted PSP models tailored by corridor or asset type;

- Strong governance and transparency, including clear KPIs and minority Transnet participation;

- Innovative financing, blending commercial, concessional and development funding instead of relying solely on state guarantees.

If reforms succeed, the respondents said, South Africa can restore lost export volumes, lower logistics costs and reclaim its role as the gateway to Sub-Saharan Africa. Failure, however, risks permanent cargo diversion, declining fiscal revenue and further deterioration of public infrastructure.

According to the DoT, the message from both local and international stakeholders is clear: the market is ready; the assets exist; the window is closing. What South Africa needs now is decisive action to turn plans into performance and partnerships into progress.

In 2025, the Minister of Transport set a national rail freight target of 250 million tonnes for the year 2029/30.

Both the RfI analysis results report and the rail passenger RFIs are available on the DoT and DBSA’s websites or directly at www.psp-rfi.co.za.

Top photo: PRASA's X'Trapolis mega EMU train (Source: DoT)

Discover

myConstructAfrica

Your one-stop-shop for information and actionable intelligence on the construction and infrastructure pipeline in African countries

- News, analysis and commentary to keep up-to-date with the construction landscape in Africa.

- Industry Reports providing strategic competitive intelligence on construction markets in African countries for analysts and decision-makers.

- Pipeline Platform tracking construction and infrastructure project opportunities across Africa from conception to completion.

- Access to contact details of developers, contractors, and consultants on construction projects in Africa.

- News and analysis on construction in Africa.

- Industry Reports on construction markets in African countries.

- Pipeline platform tracking construction and infrastructure projects in Africa.

- Access to contact details on construction projects in Africa.