Interview: Dr Nelson Ogunshakin OBE, AEO Group

Free“I am a strong believer in the idea that African challenges can only be resolved by Africans,” says the executive.

In late October, UAE-based AEO Group signed a memorandum of understanding (MoU) with the US’ ClearBid Global Markets (CBGM) aimed at redefining how capital markets support global infrastructure and real estate financing in emerging and advanced markets.

The partnership will combine AEO Group’s global strategic advisory expertise with CBGM’s capital markets innovation and digital bond marketplace, in a move designed to simplify and accelerate financing for infrastructure and real estate schemes worldwide.

Through this collaboration, both firms will integrate strategic front-end advisory with digital bond issuance, with the target of enabling clients to access competitive funding structures and broaden their investor reach.

Accessing the traditional bond market for primary or secondary financing of infrastructure is a challenging and protracted process, says AEO Group’s founder and chair Dr Nelson Ogunshakin.

“While CBGM has been operating in the US so far, it has identified Nigeria and the UK as their primary target and AEO Group can leverage its market knowledge and project advisory services to support developers in packaging investments to attract IFIs [international financial institutions] as well as domestic and foreign investors,” he says.

FIDIC Accomplishments

Dr Ogunshakin is no stranger to innovative practices in the engineering and construction fields. The immediate past CEO of the International Federation of Consulting Engineers (FIDIC), during his tenure, he secured licensing agreements that allowed major development banks to embed FIDIC’s standard forms in their procurement documents.

In an exclusive interview with ConstructAfrica, the executive, who is also chair of the ConstructAfrica Industry Advisory Board (CIAB), unpacks his views on the African construction and infrastructure industry and how his career and achievements have informed his perspective on the current state of affairs.

“Prior to taking up the FIDIC CEO post, the World Bank and a few of the IFIs adopted just one of the FIDIC Red Book documents on 10-year licensing arrangements, which expired three years prior to my onboarding,” he says. “FIDIC had been struggling to convince the banks to renew the licence, but this advocacy had not yielded any positive outcome.

“This became one of my top 10 priorities – to secure the renewal of the licence. I engaged with the top three major IFIs: the World Bank, African Development Bank (AfDB) and European Bank for Reconstruction and Development (EBRD) to establish their needs and concerns such as the lack of capacity building opportunities. Having understood the banks’ concerns and with the support of the FIDIC board, we established the FIDIC Credentialing body and FIDIC Academy; we reassured the banks that the two strategic operations would deliver the industry capacity building required.

“Through the new relationship, we secured two five-year (10 years) licensing for all FIDIC contract standards (Red, Yellow, Green, Gold, Silver, White), an arrangement undertaken with all eight multilateral development banks – the World Bank, AfDB, EBRD, Islamic Development Bank (IsDB), Asian Development Bank (ADB), Asian Infrastructure Investment Bank (AIIB), Caribbean Development Bank (CDB) and Inter-American Development Bank (IDB). Collectively, these banks invest approximately USD$190 billion a year. Their adoption of the FIDIC suite of contracts means standard procurement contracts – which ensure risk is allocated to those who are most capable of managing it – are assigned and the Dispute Adjudication Board (DAAB) is adopted across developing markets including on the African continent.

“The adoption of the FIDIC standards contracts by the IFIs, including the AfDB, helps to ensure all projects funded by IFIs in Africa use the same standards across the continent, provide assurance on the quality, promote transparency and integrity, and speed up capacity building across the delivery of infrastructure construction projects in Africa.”

Dr Ogunshakin’s experience as FIDIC CEO has taught him lessons that can be applied in the African construction and infrastructure market.

“It was a great honour to be appointed as the first CEO with British-African heritage of FIDIC since its formation in 1913,” he says. “[At that point], the organisation was at a crossroads and needed radical change to be fit for the future. My remit from the board and over 100-member country association was focused on strategy, transformation and delivery, and these objectives were successfully achieved before the end of my term in office.

“Representing and being the voice of the global consulting engineering profession to governments and federal, international, institutional and multinational client organisations requires one to have combined skills as a diplomat, advocate, turnaround agent, professional engineer and charismatic evangelist – to promote the FIDIC core principles and values in the planning, financing, procurement, delivery and management of social and economic infrastructure.

“The FIDIC objective is global and Africa is regional. I strongly believe the lessons learnt from my experience are transferable to help in the future in creating a more enabling environment for planning, financing and delivery in the African infrastructure and construction sector. This will require a concerted structured approach, with strong institutional leadership and industry-wide support. I believe the lesson learnt from my FIDIC experience can be leveraged to help to shape the strategic development and direction of ConstructAfrica to become the convening platform and go-to entity to drive the transformation of the African infrastructure and construction sector.”

Investment Focus

Asked what African governments should prioritise in terms of infrastructure development and construction, Dr Ogunshakin says countries across the continent should seek to invest in critical infrastructure as a priority and catalyst for economic growth across the continent.

“With a population of more than 1.56 billion and over 50% of young people under 25 years old, combined with an increasing urbanisation rate of close to 47%, [I feel] investment in power, transportation (airport, rail, road, port), digital telecommunications, water and sanitation, and climate resilience should be priority investment areas. Only by investing in these areas of construction would African countries become self-sufficient and industrialised, and less dependent on outsiders to solve our challenges.”

The continent’s infrastructure needs have been estimated to require investment of US$130-170 billion a year and a significant funding gap remains, which Dr Ogunshakin attributes to a lack of institutional capacity and inadequate funding to deliver the level of investment required to thrive.

“Governments across Africa are struggling to raise the funds to develop and deliver an integrated infrastructure programme to fill the gaps due to [these issues],” he says. “Understanding these limitations, the best governments can do is to create coherent regional or national infrastructure investment plans, provide a fitting regulatory environment, encourage adoption of good governance principles and involve the private sector in driving the delivery of the level of investment to fill gaps.

“In addition to this, the combination of AfDB, African Export-Import Bank (Afreximbank), financial institutions/bond market/private equity (PE) and pension funds (PF) can play a major role in creating appropriate instruments to plug the funding gap. AfDB and Afreximbank can provide the seed investment to develop bankable schemes, financial institutions or PE can provide the short-term finance to cover construction and initial operation in return for a reasonable and attractive RoI, and the PF and bond market can finance the secondary market of the operating assets/project.

“I also believe adopting new technology such as blockchain and tokenisation could enable democratic funding of major infrastructure and this could help fill the gaps. African governments should be bold to adopt this new means of funding projects to leap-frog and advance the development of critical infrastructure across the continent.”

Project Delivery

Dr Ogunshakin is also of the opinion there is significant opportunity to improve the current project delivery approach in order to address the infrastructure deficit in Africa.

“The delivery of any infrastructure project depends on many factors:

1) Having the appropriate and coordinated regional or national policy on infrastructure investment as an engine of economic growth;

2) Level of sophistication within the client organisation;

3) Effective project planning and development;

4) Having various skills for engineering design;

5) Ability to develop a bankable business case for the investment;

6) Availability of adequate financing instruments;

7) Capability and maturity of the supply chain within the country.

“Inadequate availability of these seven drivers makes it impossible to secure an effective project delivery mode across Africa. The situation is further challenged as most public sector clients are subject to the political cycle of elections, inadequate allocation of funds and lack of integrity in the delivery process. The combined impact of these factors often reflects on the ability to effectively deliver major capital infrastructure projects to the scheduled cost and quality.

“However, I strongly believe ConstructAfrica has a role to play in being the convening platform to stage thought leadership debates, promote best delivery practice and support capacity building. Collectively, this should help to foster improvements in the delivery model and reassure both domestic and foreign direct investors interested in the continent to address the infrastructure deficit and ultimately fuel the economic growth long overdue across Africa.”

HS2 Rail Initiative

On his appointment as the non-executive director of the board of the UK’s High-Speed 2 (HS2) rail initiative, Dr Ogunshakin says the project is a classic mega infrastructure capital scheme that involves building a new £55 billion (US$73.3 billion – 2019 price) railway system between London and Birmingham, with over 28,000 staff and full funding by the UK government through taxes.

“As a board director, I have collective responsibility for overseeing the delivery of the investment programme, which includes planning, engineering design, main civil construction works, design and procurement of the train rolling stock, signalling and communications, system integration, testing and commissioning, and delivery of safe operations services. My fiducial responsibilities as a board member includes the provision of strategic oversight, governance and compliance, financial stewardship, risk management, stakeholder engagement, project delivery, and transparency and reporting.

“In addition, I am also a member of the finance and performance committee and commercial and investment committee. Having spent eight years prior to the HS2 appointment as a board member of Transport for London (TfL) with an annual turnover of £12 billion and board member of Cross Rail/Elizabeth Line, valued at construction completion at £18 billion, I believe the experience gained and lesson learnt during this appointment could be applied to future planning and delivery of the [African Integrated High-Speed Railway Network (AIHSRN)].

“If Africa as a regional power, or any of the countries within the region, were to consider the development of such major rail infrastructure, financiers and investors would be keen to ensure the appropriate combination of institutional, engineering, delivery, corporate governance and assurance are available to deliver the expected return on investment (RoI). Given the opportunity and consensus of regional political will, and backed by appropriate financial investment, I am convinced Africa can achieve the same strategic infrastructure investment outcome.”

Dr Ogunshakin wears many hats in addition to the qualifications already mentioned. Among others, he is chair of the investment committee of ARM-Harith Infrastructure investment funds; council member of Aston University in Birmingham, UK; and vice-chair of the Nigeria Academy of Engineering’s Best Business Practice awards committee.

“The focus of all my business activities is about corporate and capital project investments within the global infrastructure and construction sector,” he says.

In November, he received the Special Appreciation, Recognition and Achievements Award from the Association for Black and Minority Ethnic Engineers in the UK (AFBE-UK).

“I was deeply touched to receive [this] award for lifetime leadership, role modelling and contributions to the global engineering and infrastructure profession, as well as my service as a founding member of the Association for Black and Minority Ethnic Engineers (AFBE) advisory board,” he says.

“To have received this special recognition achievement award in the presence of my wife and lifetime partner Helen was the most joyful reward – for her unflinching support and dedication over the years.

“While I have received many awards over the years, including being appointed an Officer of the Order of the British Empire (OBE) by the late Queen Elizabeth, this award means a lot to me as it is a recognition by both the AFBE and British Academy of Engineering. The AFBE initiative provided an opportunity to achieve three objectives; to build a strong professional community, encourage connectivity and celebrate our industry achievements. I am sure this type of initiative can be driven by ConstructAfrica in the very near future.”

Securing Africa's Future

“I am at a stage in my professional career where the primary objective is to give back and secure Africa’s infrastructure and construction industry and wider society,” says Dr Ogunshakin. “This can be achieved by leveraging my global connections, experience and capabilities in planning, finance, development, operations and asset management to deliver the future needs of the continent.

“I have been fortunate and privileged to help different countries and major multibillion-dollar corporations around the world in establishing effective governance systems, I have developed financially bankable investment projects and effective procurement systems, I have been involved in the design and delivery of major critical infrastructure assets, and I have created a robust financial assure financial process that gives confidence to investors and financiers. I see no reason why we cannot do the same for African countries through ConstructAfrica’s future activities.

“I am a strong believer in the idea that African challenges can only be resolved by Africans, not by any foreign government, institution or organisation. This is a wakeup call for all African professionals, both at home and in the diaspora, within the social, economic and infrastructure sectors, to become part of ConstructAfrica’s Ambassador programme and help us to realise the vision for Africa.

“My vision for ConstructAfrica is to become the go-to platform and source of market intelligence and thought leadership on strategic progressive subjects. ConstructAfrica should also convene meetings where governments, private sector, institutions, investors and financiers are engaged to share best practice, promote new thinking and collectively develop appropriate solutions to achieve sustainable construction and infrastructure investment for the African continent. In my mind, ConstructAfrica could be the World Economic Forum for Africa.”

Photo: Dr Nelson Ogunshakin

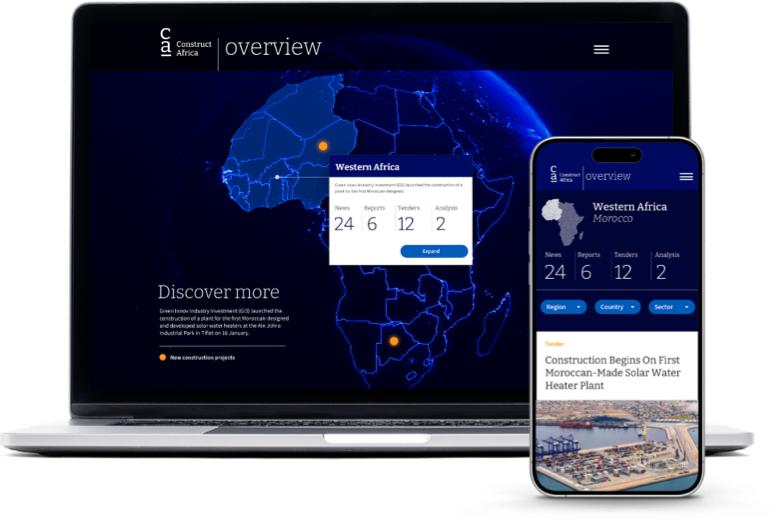

Discover

myConstructAfrica

Your one-stop-shop for information and actionable intelligence on the construction and infrastructure pipeline in African countries

- News, analysis and commentary to keep up-to-date with the construction landscape in Africa.

- Industry Reports providing strategic competitive intelligence on construction markets in African countries for analysts and decision-makers.

- Pipeline Platform tracking construction and infrastructure project opportunities across Africa from conception to completion.

- Access to contact details of developers, contractors, and consultants on construction projects in Africa.

- News and analysis on construction in Africa.

- Industry Reports on construction markets in African countries.

- Pipeline platform tracking construction and infrastructure projects in Africa.

- Access to contact details on construction projects in Africa.