Interview: Sam Nwanze, Heirs Energies

FreeThe CFO on why Africa must be allowed to develop its hydrocarbons and write its own energy narrative.

“Africa’s energy pathway must be one of addition, not subtraction,” says Sam Nwanze, executive director and CFO at Heirs Energies, a Nigeria-headquartered, indigenous owned energy company. Nwanze is referring to the blanket bans enforced by multilateral institutions on upstream oil and gas financing, which are perceived to disproportionately restrict African countries.

Calling the move a “critical miscalculation in the global energy dialogue”, the CFO says the prevailing narrative of a one-size-fits-all energy transition fundamentally ignores the principle of energy justice and the stark economic realities of the African continent.

“A policy that seeks to artificially defund and restrict African oil and gas is not a transition; it is an economic transfer that risks stalling our development and exacerbating poverty," says Nwanze. "The capital that flows from our hydrocarbon resources is the very lifeblood of national budgets, funding essential services from infrastructure and education to healthcare. To remove this foundation before a viable and scaled alternative is in place is to prioritise global carbon metrics over African human development.”

According to the African Energy Chamber, the continent holds more than 125 billion barrels of proven oil reserves and over 620 trillion cubic feet of natural gas, while more than 600 million Africans lack access to electricity and more than 900 million lack access to clean cooking fuels.

OML 17 Field

Heirs Energies is a real-life example of the benefits hydrocarbons can bring to Africa and its people. The firm became the sole operator of Oil Mining Lease (OML) 17, located in Nigeria’s Niger Delta, in 2021.

According to the firm, the field is an underexploited proven and scalable low-cost asset, with multiple low-risk opportunities to grow production and develop high-grade reserves. It has been in production since the late 1950s, with production peaking in the 1970s at 120,000 barrels of oil equivalent (boe) a day. Overall, OML 17 is estimated to hold proven and probable reserves of 1.2 billion boe, with an additional 1 billion boe of further exploration potential.

Following its acquisition of the field and through an investment of more than US$1 billion, Heirs Energies revived the brownfield asset through operational innovation, targeted capital allocation and rigorous financial discipline, with the end results being a doubling of oil output and a surge in gas production, all accomplished with a 100% Nigerian workforce and a 95% indigenous contractor base.

In just four years, oil production in OML 17 grew from 20,000 barrels a day to over 50,000 and gas production from 40 million standard cubic feet a day (scf/d) to over 100 million scf/d without the drilling of new wells. According to Heirs Energies, production doubled within just 100 days, leading to the achievement of a remarkable 99.8% reconciliation factor in a region historically plagued by losses.

Source: Heirs Energies

This turnaround was enabled by what the company calls a “brownfield excellence” strategy.

“[The] strategy is fundamentally an investment thesis in action,” says Nwanze. “It is the disciplined conviction that the most significant and immediate value in Africa's energy sector often lies not in high-risk frontier exploration, but in the prudent and strategic revitalisation of existing, mature assets.

“When we assess a brownfield opportunity, we see beyond the historical decline curves; we see a platform for value creation through operational innovation, targeted capital allocation and rigorous financial discipline.

“Our experience with OML 17 serves as a compelling case study. Upon acquisition, the asset had experienced a prolonged period of production decline. Our approach was not merely operational but deeply strategic from a capital and investment perspective. We executed a programme of structured reinvestment, deploying capital not as blanket expenditure but with surgical precision into areas with the highest potential returns: advanced seismic reinterpretation to identify bypassed reserves, well workovers and critical infrastructure integrity projects. This was coupled with a relentless focus on operational efficiency, which directly improved our terminal receipts – a key financial metric – ensuring the oil we produced was effectively and reliably monetised. This entire transformation was achieved without the need for new exploration, demonstrating the latent value that can be unlocked with the right financial and operational governance.

Heirs Energies believes this strategy is the blueprint for transformation for African independent oil and gas firms not just in Nigeria but also in the Congo, Angola, Gabon and other legacy producers.

“Mature assets can be converted into powerful engines of growth by applying a model that combines local expertise with global standards,” says Nwanze. “The cash flows generated from these revitalised assets are not just returns for investors, they are the foundational capital that can fund further exploration, support national energy security and finance the transition to a broader energy portfolio.

“In this way, brownfield excellence becomes the financial bedrock upon which a sustainable, African-led energy company is built, creating profound and lasting value for all stakeholders.”

And so, Heirs Energies is convinced the blanket ban on hydrocarbons projects financing is shortsighted.

“Gas, in particular, must be recognised not merely as a transition fuel but as a foundational fuel for our industrial and social future,” says Nwanze. “It provides the reliable, baseload power necessary to stabilise grids, fuel industries and create jobs, all while offering a cleaner alternative to traditional biomass and diesel.

“The strategic imperative for Africa is to capitalise on our natural gas resources to first achieve energy sufficiency to power our own growth. The revenues and energy security derived from this responsible development are, in fact, the essential enablers that will fund our renewable energy future. They provide the patient capital required to build solar, wind and hydrogen projects at scale.

“Therefore, our position is unequivocal: we must be granted the time and financial latitude to use our resources to build our own prosperous and sustainable energy future, one that begins with addressing the profound energy poverty that holds our continent back.”

Heirs Energies believes energy sufficiency is a foundational development priority.

“Our position on energy sufficiency is rooted in a fundamental and often overlooked reality: you cannot transition from a position of lack,” says Nwanze. “The global dialogue on energy transition is predicated on the assumption of a stable, existing energy base, which is a privilege that vast parts of Africa, with over 600 million people lacking access to electricity, simply do not enjoy.

“For us, the primary and most urgent challenge is not transition, but sufficiency. Energy sufficiency is the non-negotiable bedrock upon which all modern development is built – it powers industries, lights up homes and schools, and enables healthcare delivery. To prioritise an external decarbonisation agenda over addressing this foundational deficit is to risk perpetuating poverty and stalling economic growth for generations to come.

“Therefore, our strategy is deliberately sequential and pragmatic. We must first tackle energy poverty by utilising the resources we have in abundance, with natural gas playing a pivotal role as a cleaner, reliable and affordable bridge. Achieving sufficiency through gas and other indigenous resources creates the stable platform – the electrical grid stability, industrial activity and accumulated capital – that is a prerequisite for a meaningful and sustainable transition. The revenues generated from this phase are what will fund the massive investments required for renewables projects.

“In this context, energy sufficiency is not an alternative to the transition; it is the essential first step that ensures Africa’s energy journey is both equitable and self-determined, leading to a future where we are not just consumers of imported technology, but architects of our own energy destiny.”

Africapitalism Approach

Heirs Energies believes in harnessing local capacity for development on the continent, opining that local teams understand the terrain, culture and communities better.

“Our approach is fundamentally guided by the philosophy of Africapitalism, pioneered by our founder, Tony Elumelu,” says Nwanze. “This is not a corporate slogan but the core of our investment thesis.

“Africapitalism posits that the private sector’s most critical role in Africa is to drive economic and social prosperity through long-term investments that generate both commercial profit and widespread social wealth. For us at Heirs Energies, this means our success is measured not only by our production figures and financial returns, but by our ability to catalyse lasting economic development within Nigeria and across the continent. This is why we have made the strategic choice to employ a 100% Nigerian workforce and maintain a 95% indigenous contractor base. This is not a charitable gesture; it is a deliberate strategy to build a more resilient, innovative and culturally-attuned organisation, while simultaneously cultivating the local economic ecosystem that forms the foundation of a stable and prosperous society.

“The importance of this approach for Africa is transformative. It actively counters the historical extractive model, where resources were taken with limited local value addition. Africapitalism seeks to rewrite this narrative by ensuring capital investment, knowledge transfer and value creation occur in-country. This creates a virtuous cycle: as we develop local talent and patronise local businesses, we strengthen the economy, which in turn creates a more stable and predictable environment for further investment. It is a pragmatic and powerful model that aligns the private sector's profit motive with the public sector's development goals, proving that what is good for Africa is fundamentally good for business.”

On the prevailing notion that Africa still requires foreign skills and contractors due to a lack of skills and experience, Nwanze says the perception that Africa lacks the requisite skills is a persistent and damaging myth that Heirs Energies is dispelling through demonstrable results.

“What often exists is not a lack of talent, but a lack of opportunity and a leadership mindset that prioritises trust in local capability,” the CFO says. “Our experience stands as a powerful counter-argument – it was our 100% Nigerian team that engineered the remarkable turnaround of OML 17, doubling production where others had failed. This was not achieved in spite of our local team, but precisely because of their expertise, cultural intelligence and unwavering commitment.

“Our model proves indigeneity is a powerful competitive advantage. Local talent possesses an innate understanding of the operating environment, which leads to more effective problem-solving, stronger community relations and greater operational resilience. Building a local contractor ecosystem reduces costs, shortens supply chains and embeds our operations within the local economy, creating a shared destiny that is the best guarantor of long-term stability.

“While we remain open to strategic global partnerships for specific technologies, we firmly believe the leadership and execution must be homegrown. Heirs Energies is a testament to what is possible when African talent is given the responsibility, resources and trust to manage Africa's resources. We are not an exception to a rule; we are proof the rule itself is outdated.”

Derisking Financing

On strategies for financing African independents and de-risking mature assets, Nwanze says the financing challenge for African independents is ultimately a story about risk perception, with Heirs Energies looking to rewrite that narrative through demonstrable action.

“Traditional lenders often view mature assets on the continent through a lens of operational and political risk, leading to a prohibitive cost of capital that stifles growth,” he says. “Our approach to de-risking is therefore multifaceted, designed to build investor confidence by systematically addressing these perceived vulnerabilities. The most powerful tool in our arsenal is operational proof of concept. By taking an asset like OML 17 and, through disciplined management, doubling its production and financial performance, we transform the conversation. We are no longer asking investors to believe in potential; we are providing them with a track record of delivery, proving these assets can be stable, cash-generative engines.

“This operational credibility then allows us to structure capital in more innovative and efficient ways. We move beyond simplistic reserve-based lending to tailor financial solutions that match the specific cashflow profile of a brownfield asset. This involves a blend of corporate facilities, structured project finance and strategic partnerships that align the interests of all parties.

“Crucially, a key component of de-risking is our steadfast commitment to local partnerships and community engagement. We view our host communities not as liabilities to be managed, but as essential stakeholders in our long-term success. By ensuring local populations see tangible economic benefits – through employment, local contractor development and shared infrastructure – we create a stable operating environment. This social licence to operate is one of the most significant, yet often overlooked, risk mitigants for any financier. It is this combination of financial discipline, operational excellence and deep-rooted stakeholder alignment that allows African independents like ours to attract the capital required to unlock the next wave of value.”

Renewables Projects

Nwanze also notes that while Heirs Energies is working to make its existing oil and gas assets cleaner and more efficient, it is also focusing on expanding renewable energy schemes.

“Our strategy is best described as an integrated energy expansion where we are methodically building a platform that addresses Africa's energy needs of today while actively investing in the solutions for tomorrow,” he says. “The foundation of this expansion is the continued optimisation and responsible management of our core oil and gas assets. A critical near-term priority for us is the systematic reduction of flaring and the commercialisation of our gas resources through the Nigerian Gas Flare Commercialisation Programme. This involves projects aimed at capturing associated gas and channelling it into the domestic market, particularly for power generation. This initiative not only enhances our environmental stewardship but also directly addresses Nigeria's gas-to-power gap, turning a waste product into a vital source of energy for national development.

“Concurrently, we are actively building our renewables portfolio with a focused, commercially driven approach. As a group, we are in the advanced stages of developing several solar-powered and hybrid micro-grid projects specifically designed to provide reliable, affordable power to industrial and commercial clusters within the Niger Delta. These projects are not merely pilot studies, they are strategically chosen to deliver immediate, tangible economic impact by powering businesses and communities that are currently underserved by the national grid. This practical, rollout-ready model allows us to build operational expertise, demonstrate commercial viability and create a scalable platform.

“While our current oil and gas operations provide the financial fuel for this expansion, we are unequivocal in our belief that distributed renewable solutions like these will be the primary vectors for carrying tomorrow's growth, enabling us to expand our role as a comprehensive energy provider for Africa.”

However, at present, the sobering reality is clear for all to see. About 600 million Africans still live without electricity and Heirs Energies believes the answer to ending this crisis depends less on external capital than on something far more powerful – African accountability of African problems. Africa's energy narrative must be written by Africans and not external consultants, and the continent's focus must be on energy sufficiency.

Top photo: Sam Nwanze (Source: Heirs Energies)

Discover

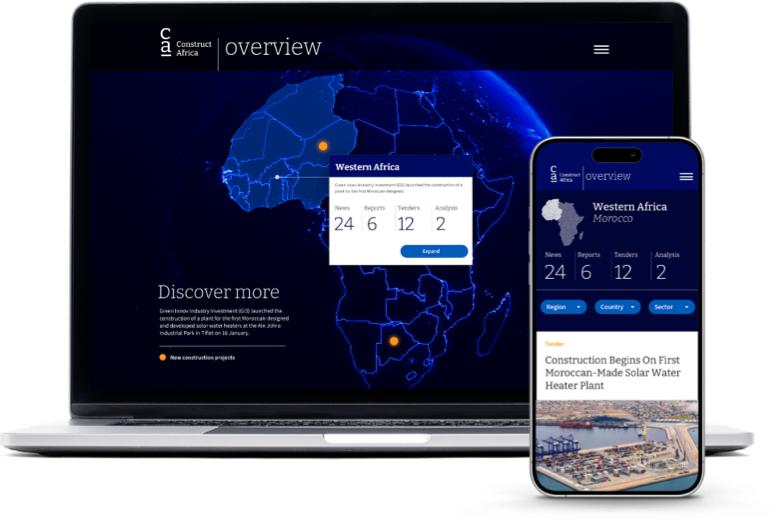

myConstructAfrica

Your one-stop-shop for information and actionable intelligence on the construction and infrastructure pipeline in African countries

- News, analysis and commentary to keep up-to-date with the construction landscape in Africa.

- Industry Reports providing strategic competitive intelligence on construction markets in African countries for analysts and decision-makers.

- Pipeline Platform tracking construction and infrastructure project opportunities across Africa from conception to completion.

- Access to contact details of developers, contractors, and consultants on construction projects in Africa.

- News and analysis on construction in Africa.

- Industry Reports on construction markets in African countries.

- Pipeline platform tracking construction and infrastructure projects in Africa.

- Access to contact details on construction projects in Africa.