Harnessing Pension Funds For African Development

FreeUS$700 billion in assets under management could be channelled into projects.

Pension funds are increasingly being seen as an opportune source of funding for the African continent’s development needs, which the African Development Bank (AfDB) has estimated will require more than US$1.3 trillion a year to meet.

African pension funds are estimated to hold US$700 billion in assets under management, which could be channelled into projects on the continent as traditional sources of foreign funding dry up due to the realignment of global geopolitics and the pace at which infrastructure requirements are expanding.

In a first, the organisations are preparing to come together to commit to a ‘Fund for Africa’ at the ‘$700b in 1 Room All Africa Pensions Summit’, which will be held from 5-7 November in Kampala, Uganda. The summit will be hosted by the National Social Security Fund (NSSF) Uganda, which is seen as East Africa’s biggest fund with a value of more than US$7 billion, under the theme ‘Pension Funds – Powering Africa’s Growth’. It is set to convene CEOs of pension funds across Africa, chief investment officers, global investors, development finance institutions, venture and private capital firms, policymakers and government officials from across the continent and beyond.

Africa’s future is in our hands, and our pensions hold the power. With over USD 700 billion in investible capital, Africa’s pension funds are shaping the next wave of growth. Join industry leaders, innovators, and policymakers at the All Africa Pension Summit in Kampala, Uganda.… pic.twitter.com/od8d0IOerR

— NSSF Uganda (@nssfug) October 20, 2025

According to Leonard Zulu, the UN’s resident coordinator for Uganda, Africa must look inward, mobilising domestic savings, diaspora remittances and blended financing models to reduce aid dependency.

“The traditional models of development cooperation are being redefined and official development assistance, though vital, is no longer sufficient to meet the scale and complexity of the challenges Africa faces today,” said Zulu, adding: “We see declining aid flows, shifting geopolitical priorities and funding uncertainties more than ever before. It is vital to formulate actionable solutions for enhanced domestic resource mobilisation and innovative financing to support national development strategies while fostering resilience and sustainability.”

Zulu noted that with 15 of the continent’s 20 traditional donor partners having reduced their funding, there is now a need to rethink how development is financed. Africa needs to shift from aid to trade, enabling small and medium enterprises to access capital, which is required to achieve the national goals.

Previously, in late September, the African Social Security Association partnered with Africa Finance Corporation (AFC) to launch the ‘Africa Saving for Growth’ programme at the UN General Assembly in New York. Aimed at unlocking US$1.17 trillion in institutional assets across Africa for the continent’s infrastructure needs, the initiative brings together social security institutions from 15 countries with more than US$54 billion in pension assets, Morocco’s Caisse de Depot et de Gestion (CDG) Group – a state-owned financial institution that manages long-term savings – and AFC. The initiative aims to build a policy reform roadmap, expand Africa’s capital pools dataset and increase allocation to infrastructure and private sector-led schemes on the continent.

Launched under the Global Africa Business Initiative (GABI) as part of the UN Global Compact, the ‘Africa Saving for Growth’ programme builds on AFC’s 2025 analysis identifying at least US$1.2 trillion in institutional assets across Africa and prioritises specific deliverables that international investors and policymakers can act on:

- Open capital-pools database: Maintain and regularly update the most comprehensive, market-accessible dataset on African institutional savings, including pension funds, insurance, social security institutions, public development banks and sovereign wealth funds

- Policy reform roadmap: Practical recommendations – prudential guidelines, risk-sharing mechanisms and intermediation vehicles – that enable pension and social security funds to invest in infrastructure while preserving asset-liability matching

- Savings mobilisation playbook: Country-level strategies to increase formal participation and reduce the drag from large informal economies

- Allocation diversification models: Pathways to shift portfolios away from short-term, low-yield instruments that concentrate public sector exposure and crowd out private enterprise

- High impact projects that can catalyse social and economic development in African countries by connecting people and countries, boost productivity, and improve quality of life of the people in Africa and ensure the sustainability of pension funds.

AFC’s 2025 findings show pension and social security portfolios across many markets are under-leveraged for development and concentrated in short-tenor instruments that limit returns and private sector financing. The ‘Africa Saving for Growth’ programme will surface replicable lessons from successful national models and chart a pragmatic route to risk-managed, long-duration allocations.

“Africa-led investment is the most effective way to quickly achieve the scale of transformation we need while catalysing international support for the continent’s infrastructure,” said Samaila Zubairu, president and CEO of AFC. “This initiative is about Africans coming together to put our own capital to work for Africa’s growth. By joining forces, our pension funds and financial institutions can unlock new opportunities, drive development and demonstrate the power of collective action to build the continent’s future without compromising fiduciary duties."

Rachel More-Oshodi, managing director and CEO of ARM-Harith Infrastructure Investment, a leading infrastructure and climate fund manager in West Africa, provides a real-life example of how African pension funds can fuel the continent’s development.

“We partnered with FSD Africa [a specialist development agency working to help make finance work for Africa's future] to structure a first-of-its-kind early yield liquidity facility, a catalytic layer that allows pension funds to receive early and predictable distributions in the initial years of the fund, essentially 'de-risking the J-curve', says More-Oshodi. “This innovation has resulted in nearly a 5x increase in local pension participation compared to our first fund.

“Traditionally, Nigerian pension funds have been reluctant to invest directly in infrastructure equity due to the delayed and back-ended nature of returns, which doesn’t match their liquidity profile or regulatory thresholds. So, with our second fund, we intentionally flipped the script.

More-Oshodi says the strategy has set a precedent. “It shows that if we design fit-for-purpose instruments that address real institutional barriers, we can unlock local capital at scale. This isn’t just theory; this is a working model that can be replicated across markets to catalyse financing for the kind of sustainable, job-creating infrastructure Africa urgently needs – from clean power plants to transport corridors and logistics hubs.

“It’s a clear example of how blended finance, when done right, can be a powerful enabler of local ownership and capital recycling. We believe this is how we build an African infrastructure ecosystem that’s not donor-dependent but domestically anchored and globally investable.”

According to ARM-Harith, the narrative of a resource-poor Africa is outdated. The continent has the capital, but what it lacks are the tools, rules and coordination to deploy that wealth into long-term development. With the right reforms and structures, Africa can build a new financing model – one where local capital leads and global capital follows.

Top photo: Construction in Africa (© Lcswart | Dreamstime.com)

Discover

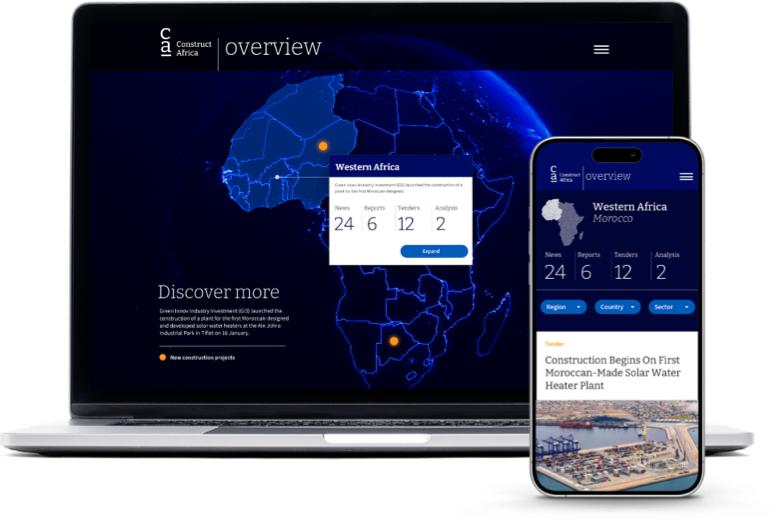

myConstructAfrica

Your one-stop-shop for information and actionable intelligence on the construction and infrastructure pipeline in African countries

- News, analysis and commentary to keep up-to-date with the construction landscape in Africa.

- Industry Reports providing strategic competitive intelligence on construction markets in African countries for analysts and decision-makers.

- Pipeline Platform tracking construction and infrastructure project opportunities across Africa from conception to completion.

- Access to contact details of developers, contractors, and consultants on construction projects in Africa.

- News and analysis on construction in Africa.

- Industry Reports on construction markets in African countries.

- Pipeline platform tracking construction and infrastructure projects in Africa.

- Access to contact details on construction projects in Africa.