Interview: Rachel More-Oshodi, ARM-Harith

FreeThe CEO on achieving breakthroughs in mobilising capital for infrastructure investment in Africa.

Rachel Moré-Oshodi is the managing director and CEO of ARM-Harith Infrastructure Investment, a leading infrastructure and climate fund manager in West Africa. In an exclusive interview with ConstructAfrica, she talks about setting the precedent for the mobilisation of capital for infrastructure investment in Africa and why project delivery modes on the continent need to change urgently.

Q) Tell us about your profile in ARM-Harith and what it does.

I serve as the CEO of ARM-Harith Infrastructure Investments, a US$200 million pan-African private equity platform dedicated to sustainable infrastructure and energy transition. We’re a joint venture between Asset & Resource Management (ARM), one of Nigeria’s leading nonbank financial institutions, and Harith General Partners, a pioneer in African infrastructure investing based in South Africa.

At ARM-Harith, we focus on closing Africa’s infrastructure gap through climate-aligned, commercially viable investments that deliver both returns and long-term impact. We deploy capital into resilient, scalable projects across power, transport, and social infrastructure, with a growing emphasis on renewables, distributed energy and hybrid solutions.

Under my leadership, we’re building a next-generation platform that not only mobilises institutional capital, including African pension funds, but also prioritises local talent, inclusive governance and measurable development outcomes. My mandate is to reposition ARM-Harith as a catalytic investor: bold in our ambitions, rigorous in execution and intentional about the kind of legacy we want to leave on the continent.

Source: ARM-Harith

Q) What are your personal interests? Could you give us some insights into your personal and professional background?

At my core, I’m driven by a deep commitment to Africa’s transformation through infrastructure, energy and economic empowerment. That’s been the throughline of my personal and professional journey.

I have spent over two decades working across five continents, leading pioneering infrastructure and energy projects worth over US$7 billion. My background spans investment banking, multilateral development finance and private equity. Over the years, I’ve worked at the intersection of strategy, innovation and execution, bringing complex transactions to life in challenging markets.

Beyond my role as CEO of ARM-Harith, I’m passionate about shaping the next generation. I recently launched Ruwah, a financial literacy platform designed to empower children and young people to build an abundance mindset and take control of their financial future. I believe that economic freedom is a building block of self-determined communities.

Personally, I’m a wife, a mother and a firm believer in the power of faith, mentorship and legacy. I read voraciously, enjoy creative writing and love connecting with people who are not only bold enough to imagine a better Africa but also courageous and disciplined enough to help build it.

Q) Recently, you posted on LinkedIn about reaching a milestone with FSD Africa that would help unlock local capital at scale. Talk to us about this milestone and its potential in funding Nigerian and African construction projects.

This milestone marks a strategic breakthrough in mobilising domestic capital for long-term infrastructure investment in Africa.

Traditionally, Nigerian pension funds have been reluctant to invest directly in infrastructure equity due to the delayed and back-ended nature of returns, which doesn’t match their liquidity profile or regulatory thresholds. So, with our second fund, we intentionally flipped the script.

We partnered with FSD Africa to structure a first-of-its-kind Early Yield Liquidity Facility, a catalytic layer that allows pension funds to receive early and predictable distributions in the initial years of the fund, essentially 'de-risking the J-curve'. This innovation has resulted in nearly a 5x increase in local pension participation compared to our first fund.

But more than that, it sets a precedent. It shows that if we design fit-for-purpose instruments that address real institutional barriers, we can unlock local capital at scale. This isn’t just theory; this is a working model that can be replicated across markets to catalyse financing for the kind of sustainable, job-creating infrastructure Africa urgently needs – from clean power plants to transport corridors and logistics hubs.

It’s a clear example of how blended finance, when done right, can be a powerful enabler of local ownership and capital recycling. We believe this is how we build an African infrastructure ecosystem that’s not donor-dependent but domestically anchored and globally investable.

Q) What is the significance of pension funds in financing projects?

Pension funds are one of the most underutilised but potentially transformational sources of long-term capital for infrastructure development in Africa.

Why? Because infrastructure is a long-duration asset class and so is pension money. These funds are built to deliver stable, long-term returns over decades, which makes them ideally suited for financing the roads, power systems, transport and digital infrastructure our economies desperately need.

In Nigeria, for example, pension assets have grown to over Naira 19 trillion [US$12.4 billion]; yet, less than 1% is allocated to infrastructure equity. That’s a massive missed opportunity, especially in a country with a US$100 billion+ infrastructure gap.

The problem isn’t the lack of interest – it’s the mismatch. Pension funds need visibility, liquidity, governance and a risk-return profile that fits their fiduciary mandate. So the challenge is not just to “mobilise” capital, it’s to design investment vehicles that are fit-for-purpose.

That’s exactly what we’ve done with our successor fund at ARM-Harith: by introducing early yield mechanisms and strong governance, we’ve aligned infrastructure equity with pension fund needs – unlocking nearly 5× their participation compared to our previous fund.

When pension funds invest in infrastructure, it creates a virtuous cycle: projects are financed with local capital, returns are recycled into the economy, jobs are created and retirees ultimately benefit from the dividends of development. That’s how we build true domestic financial sovereignty and reduce dependency on short-term or external capital.

Source: ARM-Harith

Q) In a recent LinkedIn post, you highlighted the importance of structure in attracting local capital. You also noted challenges such as currency volatility, liquidity constraints and a lack of tailored investment vehicles. Could you elaborate on these challenges and how FSD Africa's commitment is setting a precedent for other investors?

The core issue isn’t whether local capital wants to support infrastructure, it’s whether the investment structures allow them to.

In markets like Nigeria, several systemic challenges block institutional capital from flowing into infrastructure:

- Currency volatility makes it hard for investors to commit to long-term assets without reliable hedging or mechanisms to manage foreign exchange risk;

- Liquidity constraints – especially for pension funds – mean they need predictable cash flows, but infrastructure equity often comes with a long-dated, back-ended return profile;

- And, perhaps most critically, a lack of tailored investment vehicles has left investors stuck between choosing ill-suited options or sitting on the sidelines.

FSD Africa’s catalytic commitment helped us address these pain points head-on. Their Early Yield Liquidity Facility sends a strong signal: if you want to mobilise local capital, you must design for it. This facility essentially redistributes some of the early returns in a way that gives pension funds the liquidity they need without distorting the underlying risk-return profile of the fund.

This structure shows how blended finance can be strategic, not just concessional. It can derisk market entry, align incentives and prove African institutional capital can help fill the gap and be a force to be unleashed if you meet it where it is.

We hope this model paves the way for other DFIs[ development finance institutions] and concessional capital providers to rethink how they support local markets – not just by lowering risk, but by unlocking local participation at scale.

Q) FSD Africa's investment has been earmarked to support climate-resilient infrastructure projects in sectors such as energy, transport, water, and digital connectivity. Tell us about some of the projects that will be facilitated.

FSD Africa’s catalytic investment into our successor fund is enabling us to crowd in local capital for climate-smart, commercially viable infrastructure and we already have a strong pipeline of investable opportunities.

Some of the priority projects under consideration include:

- A hybrid power plant in Nigeria: This project will deliver reliable, affordable electricity to industrial clusters using a mix of gas and solar. It addresses two core issues at once: decarbonising energy supply and improving power availability for SMEs and manufacturers – sectors that drive jobs and productivity;

- A waste-to-energy project in Lagos: We’re evaluating a public-private partnership [PPP] that would convert urban waste into clean energy. This addresses a triple challenge: urban waste management, energy access and carbon emissions – particularly important for rapidly growing cities like Lagos;

- A climate-resilient road and logistics corridor in West Africa: This project will improve regional trade and food systems by reducing transport time, lowering fuel use and building infrastructure designed to withstand extreme weather events;

- A digital infrastructure investment: We’re also exploring opportunities in broadband connectivity, particularly in underserved secondary cities, which is essential for economic inclusion and resilience in a digital-first world.

Each of these projects is assessed not just for commercial viability, but for alignment with our climate and social impact goals, including job creation, gender equity and adaptation co-benefits.

FSD Africa’s early-yield commitment was instrumental in helping us secure the local pension capital needed to bring these projects to life. This is what climate finance should look like: market-responsive, locally anchored and impact-driven.

Q) ARM-Harith's 2024 annual report mentions a collaboration with FSD Africa and other key partners on a pioneering project to explore transferring assets from multilateral development banks (MDBs) to domestic institutional investors in Africa using a local currency solution. Could you comment on this initiative and its potential benefits for the African construction sector?

This initiative is about unlocking a missing middle in Africa’s capital markets and it’s one of the most exciting pieces of work we’re engaged in.

The basic idea is this: MDBs often originate high-quality infrastructure assets – they take early development risk, provide concessional capital and hold assets on their balance sheets. But those assets are rarely recycled into the domestic market, which limits capital velocity and crowding-in.

Our collaboration with FSD Africa and other partners is exploring a local currency securitisation mechanism that would allow MDB-originated infrastructure assets – once de-risked and operational – to be sold or transferred into investment vehicles held by local institutional investors such as pension funds and insurance companies.

Why is this so powerful? First, it introduces liquidity into MDB pipelines and frees up capital for new project origination, accelerating infrastructure development.

Second, it gives domestic investors access to high-quality, yielding infrastructure assets without forcing them to take construction or FX risk – a major barrier today.

Third, it creates a secondary market for infrastructure assets – something African economies desperately need to deepen capital markets and foster financial innovation.

For the construction sector, specifically, this could be transformative. If MDBs can recycle capital faster, it means more projects get financed more often. And if local capital flows in through structured vehicles, it provides a long-term anchor that reduces dependency on short-term or offshore funding.

It’s a structural fix to a structural problem; and while we’re still in the design phase, this collaboration could catalyse a virtuous cycle of project origination, asset recycling and local capital mobilisation that fundamentally reshapes infrastructure financing across the continent.

Q) What other feasible strategies do you see for scaling capital to support Africa’s infrastructure growth?

Scaling capital for Africa’s infrastructure isn’t a capital 'availability' problem – it’s a capital 'alignment' problem. Global capital exists, but it’s not flowing at the volume or speed needed because risk, return and structure are misaligned. To close that gap, here are four key strategies I believe are both feasible and urgent:

1. Local Currency Blended Finance Platforms

We need more 'fit-for-context' structures that blend concessional, catalytic and commercial capital in local currency. This removes FX mismatch for both governments and local investors, and gives projects the financial architecture to succeed from day one. Our early-yield structure with FSD Africa is an example of this and it’s highly replicable.

2. Credit Enhancement and Guarantee Mechanisms

DFIs and institutions like GuarantCo and [African Trade & Investment Development Insurance (ATIDI)] can do more to de-risk infrastructure through partial credit guarantees, political risk insurance and construction wrap guarantees. These tools help crowd-in both local and international capital by addressing the specific risks investors can’t price. But they must be more accessible, faster to deploy and better integrated into investment vehicles – not just project-level solutions.

3. Asset Recycling and Securitisation of Operational Infrastructure

As highlighted in our collaboration with FSD Africa, we must create pathways to transfer yielding, de-risked infrastructure assets from MDBs or DFIs to African pension funds through local currency securitisation. This creates liquidity, deepens the market and helps local capital participate without taking early-stage risks.

4. Strengthening Project Preparation and Bankability

You can't scale capital without a bankable pipeline. We need to invest in robust project development platforms that improve the quality of infrastructure preparation, especially for climate-resilient and sustainable infrastructure. Standardisation of contracts, open-access data rooms and early-stage capital support will help move more projects from concept to close.

Ultimately, we must move from 'project-by-project deals' to 'platforms and structures' that scale. That requires collaboration between DFIs, governments, private capital and local financial institutions – each playing to their strengths. At ARM-Harith, we are committed to being at the centre of this structural shift because we know that how we finance infrastructure is just as important as what we finance.

Source: LinkedIn

Q) Do you think project delivery modes need to change to plug Africa’s infrastructure deficit?

Yes and urgently. Africa doesn’t just need more infrastructure. It needs better, faster and more inclusive delivery of infrastructure. That means rethinking the how, not just the what.

The traditional model, where governments initiate projects, seek financing and then slowly move through procurement and execution, is often too slow, fragmented and politically exposed to deliver at the pace we need. We must adopt new delivery modes that are fit-for-purpose, including:

1. Aggregation and Programmatic Approaches

Instead of funding individual, one-off projects, we need to aggregate similar projects like solar mini-grids, distributed logistics hubs or urban water systems into bankable portfolios that can attract institutional capital and benefit from economies of scale.

2. Public-Private Partnership (PPP) Reform

PPPs have enormous potential but often suffer from poor preparation, opaque processes and weak risk allocation. We need next-generation PPP frameworks that are transparent, investor-friendly and backed by enforceable dispute resolution mechanisms. Governments must become enablers, not executors.

3. Development Led by the Private Sector

We’re seeing growing success with private sector-led infrastructure development, especially where strong offtake exists, such as industrial parks, hybrid power systems and digital infrastructure. These models are faster, more cost-effective and can reduce the fiscal burden on governments.

4. Localised and Modular Delivery Models

Africa’s infrastructure needs are not always 'mega' in nature. Sometimes the most effective solutions are modular and decentralised, like captive power plants, smart microgrids or satellite-based broadband. These are faster to deploy, easier to scale and often more resilient.

5. Stronger Project Preparation Ecosystems

Regardless of the delivery mode, project preparation must be professionalised and institutionalised. The biggest bottleneck is not capital, it’s the lack of well-prepared, investment-ready projects. That’s where blended finance, technical assistance and project development facilities must be concentrated.

If we want to plug Africa’s infrastructure deficit – now estimated at over $100 billion annually – we can’t do it with 20th-century delivery models. We need fit-for-21st-century ecosystems: agile, blended, digitally enabled and locally anchored. That’s the shift we’re championing at ARM-Harith.

Q) What role do you think ConstructAfrica can play to support you and ARM-Harith in improving the construction industry in Africa?

ConstructAfrica has a critical role to play – not just as an information hub, but as a catalyst in shaping a stronger, more transparent and more connected construction ecosystem on the continent.

For ARM-Harith and for investors like us, three things matter deeply when it comes to construction: trust, visibility and standards. That’s where ConstructAfrica can be a powerful partner in:

- Providing reliable data and market intelligence on projects and contractors;

- Showcasing best practices to raise accountability and delivery standards;

- Convening the right players – financiers, developers and policymakers – to drive collaboration;

- Reshaping the narrative so Africa’s construction industry is seen not just in terms of deficits, but in terms of innovation and opportunity.

At ARM-Harith, we see ConstructAfrica as a strategic partner that can help align the construction sector with the capital, standards and ambition needed to truly transform Africa’s infrastructure landscape. Together, we can help ensure projects aren’t just financed but delivered sustainably and at scale.

Top photo: Rachel More-Oshodi (Source: LinkedIn)

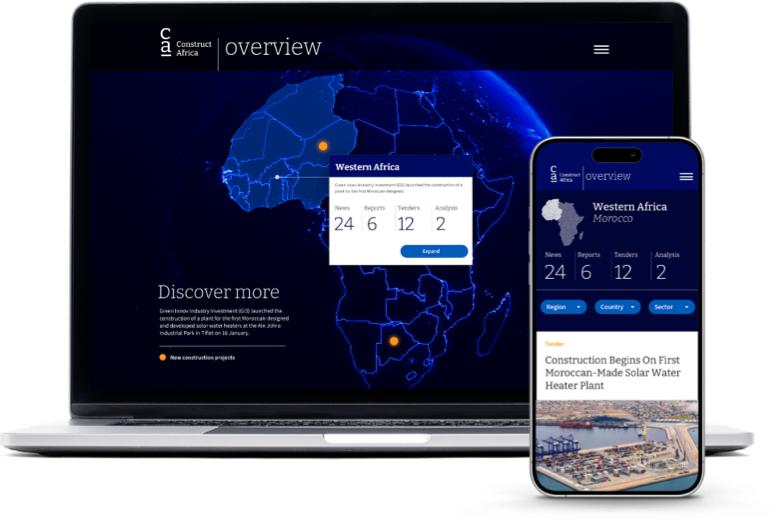

Discover

myConstructAfrica

Your one-stop-shop for information and actionable intelligence on the construction and infrastructure pipeline in African countries

- News, analysis and commentary to keep up-to-date with the construction landscape in Africa.

- Industry Reports providing strategic competitive intelligence on construction markets in African countries for analysts and decision-makers.

- Pipeline Platform tracking construction and infrastructure project opportunities across Africa from conception to completion.

- Access to contact details of developers, contractors, and consultants on construction projects in Africa.

- News and analysis on construction in Africa.

- Industry Reports on construction markets in African countries.

- Pipeline platform tracking construction and infrastructure projects in Africa.

- Access to contact details on construction projects in Africa.