Work To Begin In 2026 On Abidjan-Lagos Highway

FreeConstruction of 1,028km supranational highway to be concluded in four years.

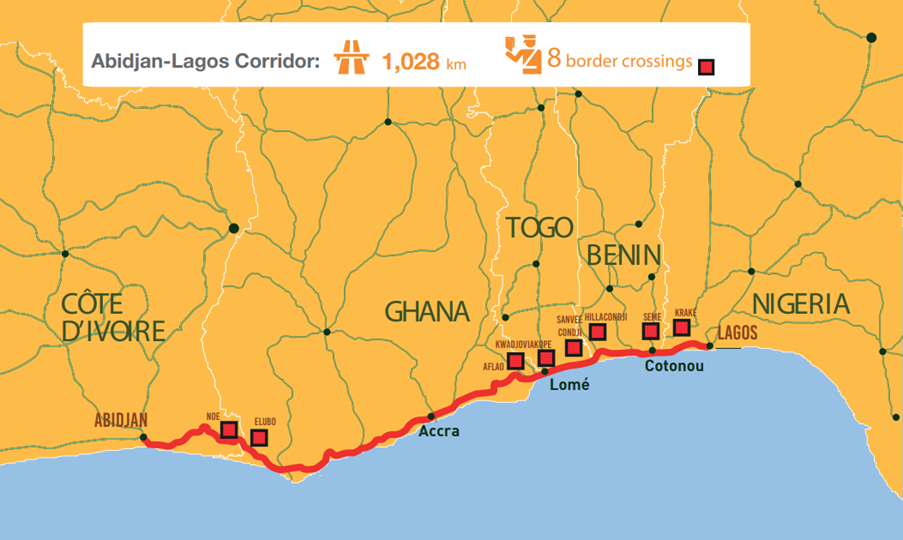

Work is due to commence in 2026 on the 1,028km Abidjan-Lagos corridor highway project and is earmarked for completion in 2030, according to the African Development Bank (AfDB).

The bank revealed the dates at an online workshop held on 22 November with the project partners. The AfDB is financing the technical studies for the highway scheme, with contributions from the EU, the ECOWAS Commission and the five corridor countries of Cote d’Ivoire, Ghana, Togo, Benin and Nigeria.

The Abidjan-Lagos corridor highway project will be a toll-free, dual-carriage supranational highway connecting the economic capitals of the corridor states. It will have four to six lanes, with up to eight lanes in Lagos. About 144km of the route will pass through Cote d’Ivoire, while 520km will be located in Ghana, 90km in Togo, 127km in Benin and 82km in Nigeria.

The project includes the construction of eight border crossing points and there are also plans to build 63 interchanges. Most of the work will be carried out in the form of public-private partnerships (PPPs) and 70,000 direct and indirect jobs are expected to be created during the roadworks.

According to the AfDB, the Abidjan-Lagos highway will link an urban population expected to reach 173 million people by 2050 and connect the most economically dynamic and densely populated metropolitan areas in West Africa from Abidjan, Takoradi and Accra, to Lome, Cotonou, Porto-Novo and Lagos.

Source: ECOWAS Commission

“The Abidjan-Lagos highway will connect with the West African transport corridors (airport, road and rail) and will link the inland regions of Mali, Burkina Faso and Niger to all eight ports in the corridor, as well as to the Abidjan-Dakar-Praia corridor,” said Lydie Ehouman, the AfDB’s chief transport economist and project manager. These ports handle 85% of Europe’s maritime freight.

The AfDB is also promoting a spatial development initiative (SDI) for the highway project, which aims to turn the corridor into an economic and industrial hub through primarily private sector investments.

A validation workshop was held in mid-November for the draft final report of the SDI study, which is being undertaken by a consortium of Canada’s CPCS, South Africa’s Holland & Hausberger and Tunisia-based Comete Engineering.

The overall objective of the study is to identify and unlock the inherent and latent economic potential and commercial viability of economic and industrial value chain projects linked to the highway. Once implemented, these schemes will also generate trade volumes and traffic to augment the highway’s viability.

The consultancy team has identified specific infrastructure interventions within a 200km catchment area of the Abidjan-Lagos corridor, with three types of projects considered, namely economic anchor, strategic infrastructure, and densification and deepening schemes.

The industries targeted include renewable energy, manufacturing, transport and logistics, oil and gas, agriculture and agro-industry, information and communications technology (ICT), tourism, mining and special economic zones (SEZs).

Major catalytic anchor projects identified for the highway are the Remo Economic Industrial Cluster in Nigeria, Glo-Djigbe Industrial Zone (GDIZ) in Benin, Adetikope Industrial Zone Cluster in Togo, Greater Kumasi Industrial City in Ghana and PK 24 Industrial Hub in Cote d’Ivoire.

“This economic corridor approach also naturally overlaps with major urban development,” said Mike Salawou, director of the AfDB’s infrastructure and urban development department.

“It will support the growth of major economic hubs and improve links between large urban centres, secondary cities and rural areas within the five countries. The bank has launched the [SDI] to enable transformative industrialisation right along the highway, to stimulate the growth of major economic clusters.”

The project identification and shortlisting followed rigorous criteria covering contribution to regional integration, financial, economic, social and environmental justification, and readiness for implementation. Synergies with national masterplans and policies as well as forward and backward linkages were considered.

A corridor investment plan is expected to have been finalised at the end of the validation workshop, which includes 26 project clusters encompassing 78 shortlisted schemes and 120 deepening and densifying projects for a total of 206 projects. Of this total, 27 schemes are investment-ready and estimated to require US$6.8 billion in potential investment.

“Our ultimate objective is to ensure the corridor and the economic activities to be developed along the corridor contribute to the ECOWAS regional integration agenda,” said Chris Appiah, transport director at the ECOWAS Commission. “It's an integrated project, which, once implemented, will help us to achieve the economic union we desire in our area.”

The commission and corridor states will receive the Abidjan-Lagos highway’s final design reports, financial and implementation strategy, tender documents and all related documents by mid-December.

Following this, the commission will embark on investor roundtables and roadshows to secure the over US$12 billion of capital investment needed to construct the supranational highway. In 2021, US$15.6 billion in potential investment had been pledged by various private and institutional actors for the scheme.

Cote d’Ivoire will host the Abidjan-Lagos Corridor Highway Management Authority (ALCoMA), the supranational body mandated to construct, manage and operate the corridor on behalf of Benin, Cote d’Ivoire, Ghana, Nigeria and Togo. The institutional arrangements for operationalising the authority have already been overseen.

Additionally, in June, the ECOWAS Commission held a technical review of a draft interim report for the trade and transport facilitation study of the highway project. The aim is to develop a framework that will allow the corridor to be operated under a single customs regime with no borders. This will include a corridor-wide automated third-party insurance scheme, called the ECOWAS Brown Card, for cross-border vehicles.

Top photo: Port road (Source: Facebook @ AfDB)

Discover

myConstructAfrica

Your one-stop-shop for information and actionable intelligence on the construction and infrastructure pipeline in African countries

- News, analysis and commentary to keep up-to-date with the construction landscape in Africa.

- Industry Reports providing strategic competitive intelligence on construction markets in African countries for analysts and decision-makers.

- Pipeline Platform tracking construction and infrastructure project opportunities across Africa from conception to completion.

- Access to contact details of developers, contractors, and consultants on construction projects in Africa.

- News and analysis on construction in Africa.

- Industry Reports on construction markets in African countries.

- Pipeline platform tracking construction and infrastructure projects in Africa.

- Access to contact details on construction projects in Africa.