Logistics And Supply Issues Threaten African Construction

FreeNew Turner & Townsend report analyses construction costs and trends.

Limitations in logistics and supply chains could create a barrier to investment in the African construction market, says a new report from UK-based consultancy Turner & Townsend.

According to the Global Construction Market Intelligence (GCMI) 2025 report, published in early July, a historic underinvestment in logistics networks and the limited number of top-tier contractors able to take on larger programmes could affect the continent’s otherwise positive growth trajectory.

Africa is experiencing a rapid growth in populations, an increase in spending on renewable energy, particularly in East Africa, and significant investment in modernisation and urbanisation. This, combined with low construction costs, offers an appealing outlook for investment and is creating a strong sense of optimism in many areas, says the report.

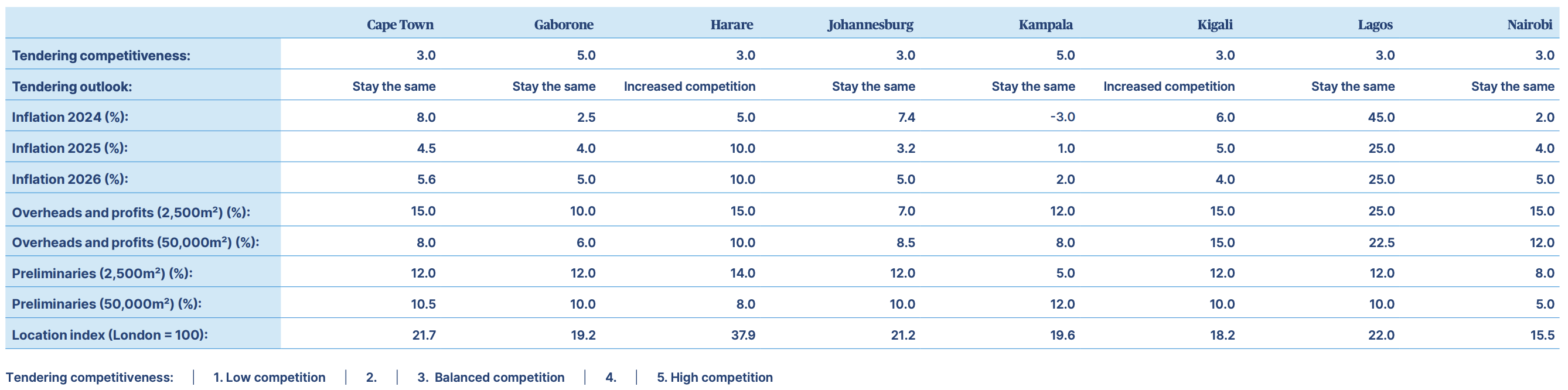

Good labour availability and access to materials have maintained low construction costs at an average of just US$1,188 per square metre across Africa, with inflation in most locations manageable at low single figures. Despite some local currency fluctuations affecting construction costs in dollar terms, such as inflation of 45% in Nigeria’s Lagos in 2024, most regions are stable, with recent global trade negotiations having a relatively mild short-term impact due to economies not being closely tied to the US.

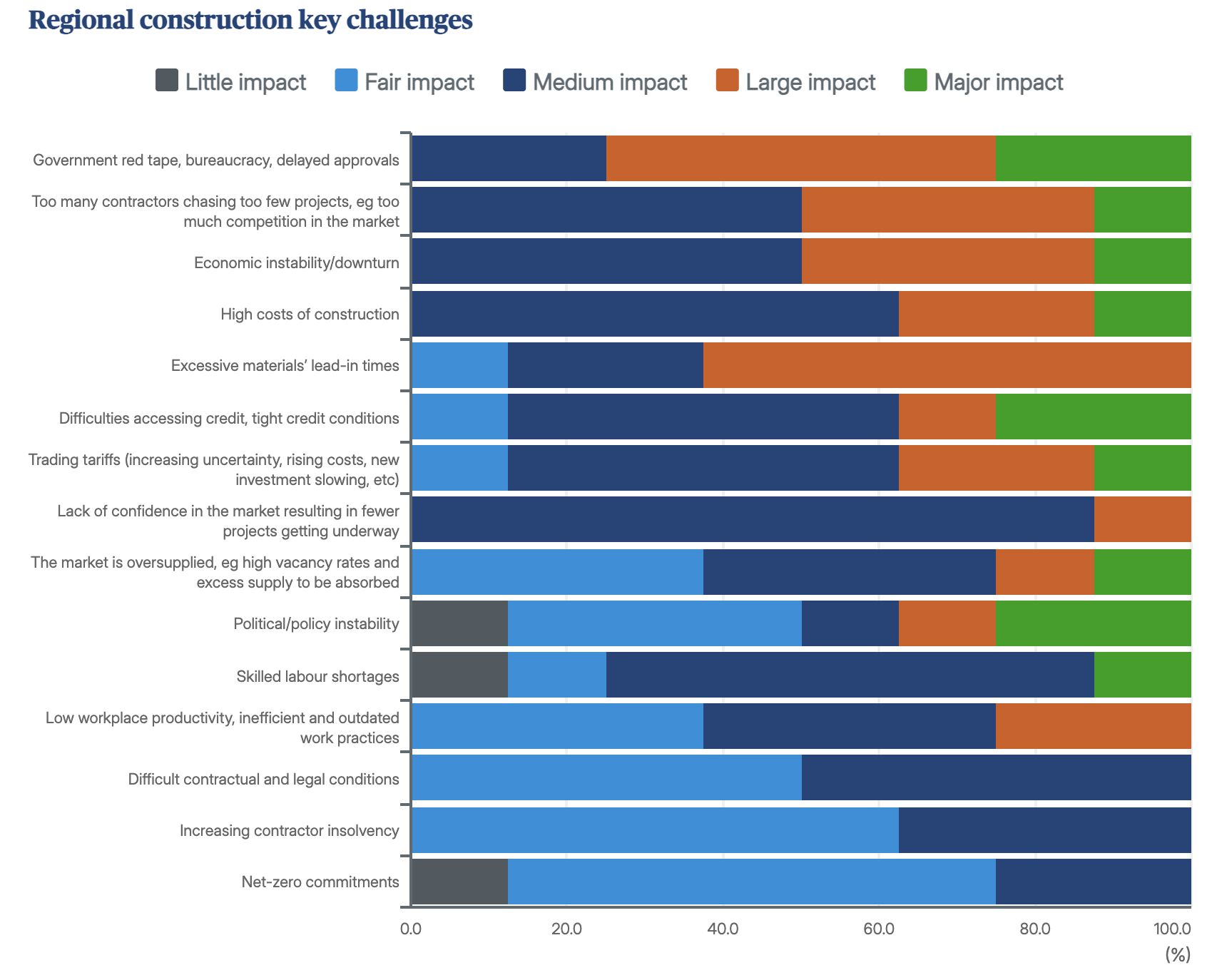

The challenge for stakeholders to tackle is therefore less around cost and instead around choices over labour and logistics – ensuring skills and materials are directed to where they are needed, says the GCMI report.

The region has often seen relatively high competition for work, but important shortages are now emerging. The limited number of top-tier contractors able to take on the bigger programmes, notably in South Africa, risks reducing tender price competition. High unemployment could set the stage for more local retraining and upskilling to fill the gap in the market, but this is not yet commonplace.

The report says clients will need to take a more active role to bridge the gap where there are shortages – directly investing in training local skills, or bringing in international expertise where needed – to prevent programmes being affected.

Source: Turner & Townsend

“There are plentiful signs for optimism across Africa, with growing opportunities to drive investment that supports economic diversification,” says Wendy Cerutti, director and regional real estate lead for Africa at Turner & Townsend.

“As well as the greater urbanisation and development of social infrastructure we’re seeing on the back of many regions’ growing populations, there is also a significant focus on high-tech industries from advanced manufacturing to data centres, as well as major government spending on renewables.

“The counterpoint to growth is that it comes with supply chain challenges – making labour and logistics the priorities for clients. Important shortages are now emerging in terms of top-tier contractors and specialist skills, which clients need to proactively manage by taking greater ownership of construction infrastructure and directly building up the skills they need either locally or through importing labour. Doing this successfully will require programmatic thinking from clients to derisk projects.”

Source: Turner & Townsend

The African Continental Free Trade Area (AfCFTA), mandated to create a single continental market and which came into force in 2021, could help solve these issues. According to Segun Faniran, founder and publisher of ConstructAfrica, the AfCFTA – projected to boost intra-Africa trade by 40% by 2045 – could enhance investments, cross-border contracting and construction business opportunities, as well as mobility for a skilled workforce.

For investments, the AfCFTA single market for construction goods and services across the continent will widen the pool of investment opportunities available in this sector in African countries, making them more attractive to foreign investors. A single unified market will also attract foreign investors looking for opportunities in a stable and predictable environment. This will lead to increased capital inflow into construction schemes across the continent, ultimately boosting infrastructure development.

Regarding cross-border contracting, the AfCFTA’s creation of a continental market of more than 1.3 billion people will drive demand for construction services and materials. The presence of more players in the continent-wide market will lead to innovation and better quality services at competitive prices. In addition, collaborative projects, funded by multiple countries across borders and by financial institutions, can be initiated, leading to improved infrastructure.

Enhanced cross-border collaboration between governments and the private sector can also foster more public-private partnerships (PPPs), providing access to a wider pool of essential funding and expertise.

With the AfCFTA improving mobility for skilled labour, this could help address worker shortages in various regions, allowing for the transfer of expertise and best practices. Professionals can also establish networks across borders, facilitating partnerships and collaborations on construction projects. In addition, increased mobility may lead to more integrated training programmes, enhancing skills and capabilities within the workforce.

Costs and trends

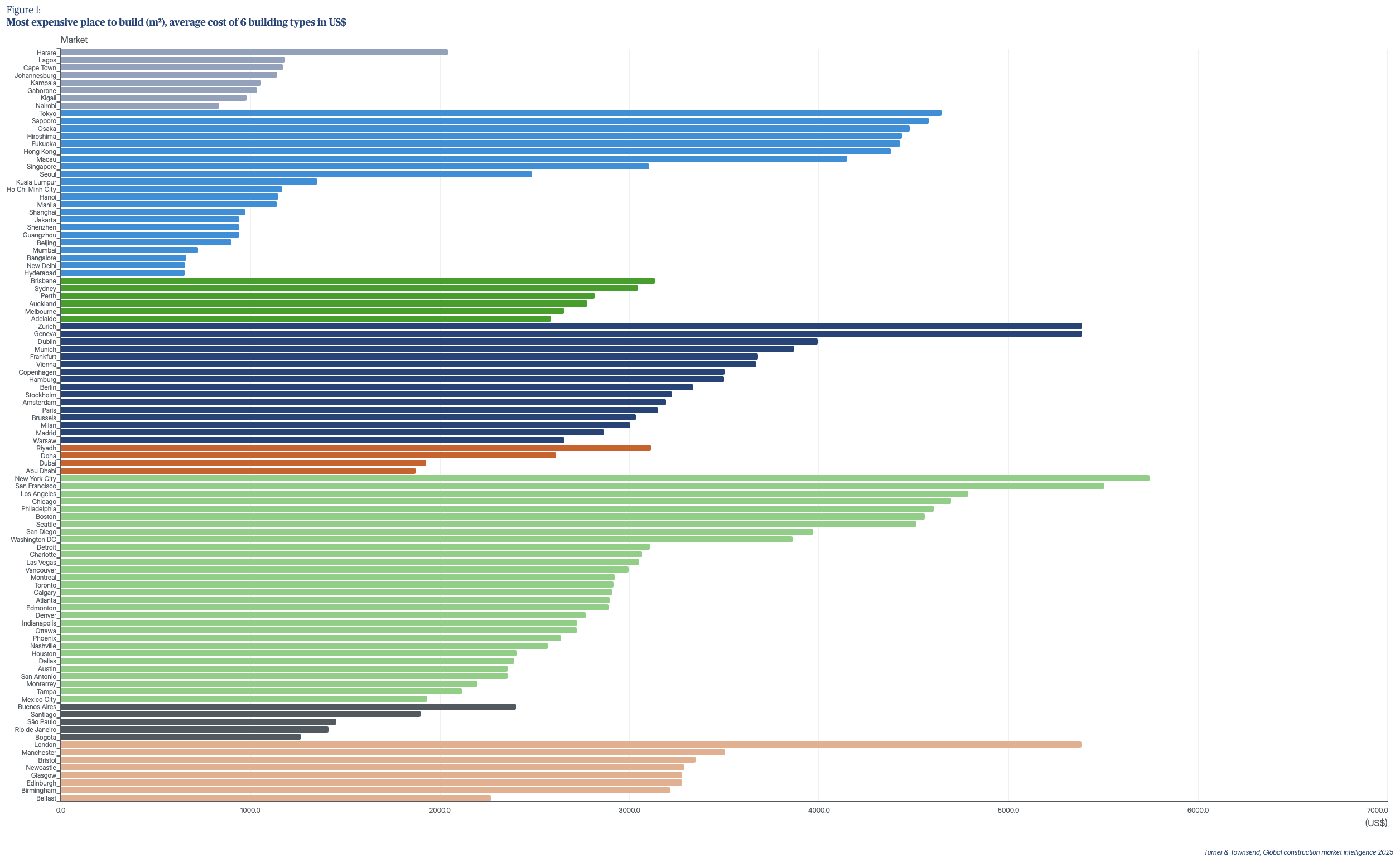

Turner & Townsend’s GCMI report also analyses construction costs and trends across the continent, with Harare in Zimbabwe pegged as the most expensive African construction market, at US$2,042 per sq m, which is US$800 more than Lagos, in second place at US$1,183 per sq m. Despite this, Zimbabwe is expected to continue on its growth path, having invested in recent years in a diversified set of markets ranging from tourism and leisure through to infrastructure.

Meanwhile, Rwanda remains the second-most inexpensive construction market in Africa, at US$979 per sq m, bolstered by the government’s embrace of modernisation and urbanisation, including a focus on affordable housing and infrastructure.

Access to sustainable and resilient power is a high priority for markets worldwide and an area where Africa sits in a position of strength, says the GCMI report. Government spending in East Africa on renewables and grid resilience is helping to keep power costs low, attracting investments into energy-intensive sectors including data centres and advanced manufacturing. In Kenya, where costs in the capital average US$834 per sq m, this power availability is combining with a stable currency and low import duties to draw in investment, the report says.

South Africa, traditionally one of the strongest African construction markets, is seeing the benefits of overall economic recovery and a government of national unity, but inflation driven by high fuel prices remains a concern, says the GCMI report. Public and private investment in mixed-use regeneration, education, residential housing and energy, and power infrastructure is creating opportunities, but the data points to an uneven market across major cities in the country.

Costs in Cape Town sit at an average of US$1,231 per sq m, rising at a rate of 9% through 2025. In comparison, increased competition for work in Johannesburg means the rate of construction cost inflation is set to fall this year to 3.2%, compared with 7.4% in 2024.

Globally, two US cities feature at the top of the GCMI ranking – New York retains its position as the most expensive construction market at US$5,744 per sq m, followed by San Francisco in second place at US$5,504 per sq m. Zurich in Switzerland rounds out the top three at US$5,386.4 per sq m.

Source: Turner & Townsend

Top photo: Construction (© 2day929 | Dreamstime.com)

Discover

myConstructAfrica

Your one-stop-shop for information and actionable intelligence on the construction and infrastructure pipeline in African countries

- News, analysis and commentary to keep up-to-date with the construction landscape in Africa.

- Industry Reports providing strategic competitive intelligence on construction markets in African countries for analysts and decision-makers.

- Pipeline Platform tracking construction and infrastructure project opportunities across Africa from conception to completion.

- Access to contact details of developers, contractors, and consultants on construction projects in Africa.

- News and analysis on construction in Africa.

- Industry Reports on construction markets in African countries.

- Pipeline platform tracking construction and infrastructure projects in Africa.

- Access to contact details on construction projects in Africa.