Interview: Mark Worrall, Estates and Infrastructure Exchange

FreeAfrica represents one of the greatest infrastructure opportunities in the world, says the CEO.

Project delivery modes need to change in order to plug Africa’s infrastructure deficit, according to Mark Worrall, CEO of Estates and Infrastructure Exchange (EIX), a regulated global platform that is transforming how infrastructure schemes are financed, structured and traded.

The traditional design-build-finance-operate model cannot solely meet the continent’s infrastructure needs – estimated at US$130 billion-US$170 billion a year – as it often fails in environments with limited upfront equity or high sovereign risk premiums, says Worrall.

“Instead, we need capital-aligned delivery, where the project is structured around the risk appetites and timelines of institutional investors. This requires modular development, transparent digital reporting and outcome-based risk mitigation – exactly what our platform [EIX] enables.

“EIX designs and brings to market credit-rated, index-linked infrastructure bonds that qualify under Solvency II Matching Adjustment rules. Our model enables insurance and pension investors to fund sustainable infrastructure efficiently, at scale and with capital adequacy requirements as low as 2-3%. By combining parametric insurance, transparent issuance through [a liquid secondary market] Aquis-EIX, and project underwriting at the capital structuring level, we’ve effectively built the next-generation infrastructure investment market.”

Indeed, insurance and pension funds have been identified as stable sources of capital that remain largely untapped and could help close Africa’s tremendous infrastructure development gap.

According to Africa Finance Corporation’s State of Africa’s Infrastructure Report 2025, published in June, the continent’s domestic capital pools have been estimated to hold over US$4 trillion, including more than US$1.6 trillion across the non-bank sector, such as US$455 billion in pensions, US$320 billion in insurance, US$250 billion in public development banks, US$150 billion in sovereign wealth funds and US$473 billion in foreign reserves.

“The private sector – especially insurers – has trillions in dry powder, but lacks products that fit liability-driven mandates,” says Worrall. “EIX helps bridge that gap by structuring projects to meet Solvency II capital standards where possible and by offering index-linked, credit-rated, insured securities. If just 1% of insurer capital were allocated to African infrastructure through this lens, it could plug more than half the gap annually.”

The CEO is cognisant of the massive opportunity that the African infrastructure market holds.

“Africa represents one of the greatest infrastructure opportunities in the world,” says Worrall. “The potential lies not only in its demographic and urbanisation trends, but also in the unique chance to leapfrog legacy finance models.

“With EIX’s capital-first methodology, African projects can be structured upfront to attract global institutional capital – especially insurance funds – without being constrained by opaque syndicate-led structures or sovereign credit dependency. The ability to list, rate and insure projects on day one opens up transformational potential for sectors such as energy, water, logistics and social infrastructure.”

On how EIX can be used to facilitate African construction projects, Worall says the company’s model is built on three core pillars. These include private placement bonds, which are project-specific, credit-rated instruments typically issued with 20-30 year terms. “Investors gain clear, transparent access to the project’s revenue streams,” says Worrall.

EIX also leverages parametric insurance, which replaces legacy guarantees and triggers immediate repayment in case of predefined project events, such as default, delay or underperformance. “It’s governed by objective metrics, giving investors confidence,” says Worrall.

The third core pillar is the Aquis-EIX secondary market, developed in partnership with UK-based financial services firm Aquis Exchange. “This is where these instruments are listed, offering liquidity and price discovery,” says Worrall. “For African projects, this means exit routes for early-stage investors, portfolio-level transparency and better pricing.

"Together, these mechanisms bring African projects into the same investable universe as developed market infrastructure assets.”

The CEO opines that African governments should focus on building resilient energy systems, urban logistics and water infrastructure, and digital connectivity. “These unlock productivity across sectors, enable regional trade and build climate resilience,” says Worrall.

“Crucially, governments should prioritise bankability, not just need. That means early feasibility, governance transparency and revenue predictability. With those in place, the capital will follow.”

EIX is currently in late-stage discussions on several projects in Africa, particularly in the waste-to-energy, renewable energy and water treatment segments. For example, the firm is working on a pan-African sustainable waste conversion initiative with industrial offtake in East Africa.

“While our project deployment in Africa is early-stage compared to Europe or North America, we are in advanced talks to bring three new African listings to Aquis-EIX in the next 12 months – all potentially investment-grade, index-linked and insured,” says Worrall.

Photo: Mark Worrall (Source: LinkedIn)

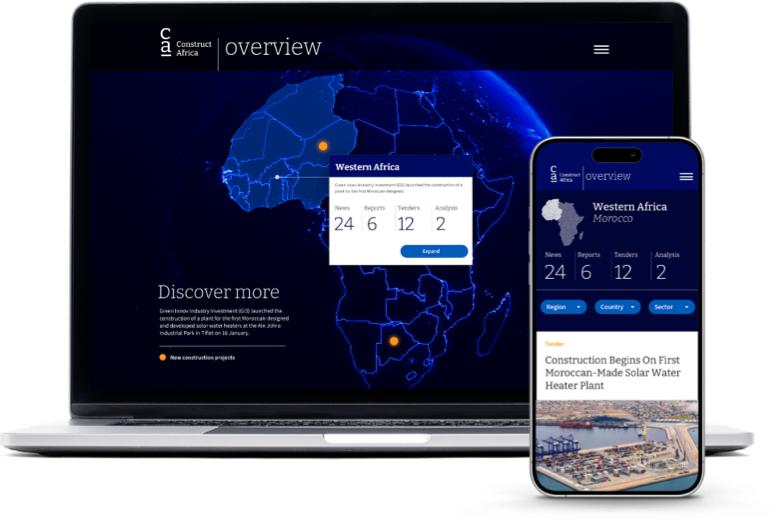

Discover

myConstructAfrica

Your one-stop-shop for information and actionable intelligence on the construction and infrastructure pipeline in African countries

- News, analysis and commentary to keep up-to-date with the construction landscape in Africa.

- Industry Reports providing strategic competitive intelligence on construction markets in African countries for analysts and decision-makers.

- Pipeline Platform tracking construction and infrastructure project opportunities across Africa from conception to completion.

- Access to contact details of developers, contractors, and consultants on construction projects in Africa.

- News and analysis on construction in Africa.

- Industry Reports on construction markets in African countries.

- Pipeline platform tracking construction and infrastructure projects in Africa.

- Access to contact details on construction projects in Africa.