Greening Africa's Construction Sector

FreeThe Unlocking Investment in Green Construction Projects in Africa webinar highlighted challenges and exciting potential.

Africa is arguably the most adversely impacted continent in the world by climate change even while being the lowest source of global carbon emissions. However, of the estimated US$1.4 trillion of climate finance available today, only about 3% of that has found its way to the continent.

This sobering reality provided a catalyst for the expert insights shared by industry leaders during ConstructAfrica’s Unlocking Investment in Green Construction Projects in Africa webinar – the fourth webinar in its Building a Better Africa series.

Hosted by Dr Nelson Ogunshakin, immediate past CEO of the International Federation of Consulting Engineers (FIDIC), the panel of experts comprised:

- Opuiyo Oforiokuma, senior partner at the Africa50 Infrastructure Acceleration Fund

- Dr Olubukola Tokede, senior lecturer at Deakin University

- Bukola Odoe, special adviser to the Office of Public-Private Partnerships of Nigeria’s Lagos state

- Matthew Jordan-Tank, director of sustainable infrastructure policy and project preparation at the European Bank for Reconstruction and Development (EBRD)

- Jenni Chamberlain, founder and CEO of Altree Capital

Current state of green construction/infrastructure in Africa

While Africa is the worst affected of continents by climate change, it is also arguably the least prepared to deal with the resultant adverse effects. But the overall mood among the panellists was one of hope and excitement. Excitement because the sheer scale of demographic growth and urbanisation in Africa means an abundance of projects and investment opportunities, the majority of them in greenfield developments.

“There's not only a huge need to get the appropriate level of infrastructure networks and service levels in place, but also you can confidently invest in that kind of environment,” said EBRD’s Jordan-Tank. The bank has now expanded to cover six Sub-Saharan African countries – Kenya, Nigeria, Ghana, Benin, Cote d'Ivoire and Senegal – with projects starting to be rolled out in the coming months.

EBRD has also recently approved its new infrastructure strategy, which focuses on building social infrastructure such as schools, hospitals and housing that meet high international green building standards.

“We believe this is the way to go, whether it's local materials, energy efficiency, the full lifecycle cost; it's got to be efficient and it has to meet those high standards,” said Jordan-Tank. “We think this is the way to go, we think it's doable and we think it's affordable as well over a whole lifecycle.”

Lagos state’s Odoe brought up the pipeline of over US$1.4 billion pitched on green projects in Africa at the 2024 Africa's Green Economy Summit (AGES), which then tripled at the 2025 summit – going over US$7 billion. “What this tells us is there's a growing interest in investing and funding green projects in Africa,” she said.

The adviser also referenced how Lagos state is soon going to be the first subnational in Sub-Saharan Africa to issue a green bond, which will include financing for solar energy to power schools and hospitals.

“This is a call to investors who want to invest in alternative projects that are designed to maybe not necessarily bring back the largest returns, but in terms of impact investing, you've got it right there,” said Odoe. “So, for us, in terms of opportunities, I would say now is the time to come into Nigeria and, by extension, Lagos state, for green energy projects.”

Altree Capital’s Chamberlain mentioned the successful sale of carbon credits by one of the firm’s portfolio companies through the Swiss government, citing it as an example of how green finance can mitigate risk and be used to address equality in many areas. “I think there are going to be increasing green finance opportunities for the continent and we're excited to be playing a role in that,” said the CEO.

Risk perception

But the challenge is the perception that Africa is, on the whole, a risky place to put money in.

“A study by McKinsey indicates that 90% of projects in Africa that start at the early development stage never get to bankability,” said Africa50’s Oforiokuma. “As a consequence, at the very early stage of the overall lifecycle, the risks are highest.”

The approach taken must be holistic in nature, keeping in mind that huge swathes of the continent are still grappling with issues related to poverty, said the financier.

“The basic need to develop, especially energy sources, itself is a challenge, because some of the green energy solutions themselves are not truly sufficient on the continent. And we need a balanced energy mix, while technology and other solutions come about, to ensure the baseload energy available to support development.

“So, there are cultural, physical, financial and other dimensions that have to be thought through especially when we talk about focusing on a green concept. But is it a good idea to think about it? Absolutely.

“If we can be dedicated to seeing the success of projects we develop on the continent, the risk perception of Africa will diminish. If you look at studies by Moody's [Investors Service] on default rates on African infrastructure and infrastructure across the world, I believe in the latest study, Africa has the lowest default rate, something about 1-2% compared to a much higher rate of 7-10% in more developed parts of the world. So, Africa isn't that risky; you can get things done.”

Source: GBCSA

Deakin University’s Dr Tokede said there is indeed an opportunity for Africans to learn from best practices in green construction seen in other parts of the world. But looming over this opportunity is the lack of basic infrastructure to facilitate green construction, particularly with regards to electricity generation and having to deal with poverty. “Because a lot of lack happens in that context, a lot of people tend to back out of even green construction, despite the fact that it may have a payoff environmentally in the long run.

“[The approach] has to be holistic in the sense that we will struggle to grow green without actually addressing some of those economic complexities that we face all across Africa.

The professor, however, noted that governments and investors would do well to tackle realistic goals, or what he called “low-hanging fruit”, such as embodied carbon, where the focus shifts to the materials being used, how they are procured and what their global warming potential is, in addition to the energies being used to develop and operate the infrastructure.

“If we think about places like Indonesia, China, we're starting to see a lot of high-speed rail projects,” said Dr Tokede. “Although these things are very expensive, because the demographics of Africa are quite huge, these are very timely investments that we should be thinking about. So, the methodology I would advocate for and that should be embraced by policymakers is looking at how we can start to look at lifecycle assessment and also carbon accounting and embodied carbon calculations. And I think that itself is going to be a step forward for us.”

Chamberlain noted that there is a perception that costs are significantly higher when dealing with manufacturing or constructing green projects in Africa.

“I think the regulatory environment is still complex globally, as a result of the Paris climate agreement. And that takes a lot of negotiation. Unfortunately, the continent also [to an extent] lacks [the knowledge and skills] to be able to execute on this.

“[There are also] land planning issues and environmental resource stresses [to be taken into account]. But we see huge opportunity at the same time to use green finance to transform our economies in a kind of just energy transition.”

Part of Africa’s challenge is that there is a perception that everything is so difficult and the scale is not there yet, said Jordan-Tank.

“There's a lack of awareness of the reality on the ground. I think the perceptions are misaligned with reality. So, what we'd like to do is be humble and partner with organisations and people who have been doing successful projects. We're setting up local offices in all of our [SSA member] countries.

“We want to bring what we've done best as EBRD in the past, which is focusing on specific projects with strong institutional and regulatory support behind them, making sure there's creditworthiness to do the projects, providing support to government actors to prepare the projects robustly.

“And then, wherever it makes sense, we bring in the private sector to invest in these projects. And that's where our advisory work on PPPs comes into play. So it's really about just seeing where we can work. There are already interesting opportunities coming up. We're going to be rolling those out in the next months. But overall, I see it as a glass half full.

Securing funding and the role of financial institutions

Outlining the scale of the funding challenge faced by the continent, Oforiokuma noted that the African Development Bank (AfDB) has estimated an annual investment cost of US$495 billion between now and 2030 to fund infrastructure (factoring in adaptation, mitigation and resilience).

“And then, when you look at the available financing – I'm using 2024 figures here – compared to that need, the gap is still about US$400 billion annually. So, having access to capital is really, really important.

“We can look at capital from sources outside and within Africa. AfDB has estimated there's something like about US$2.5 trillion of assets under management by African institutions such as pension funds, insurance funds, sovereign wealth funds and others, some of which if channelled towards infrastructure would be a great help.

“Now that capital can play a role in various ways. The vast majority of Africa’s need is greenfield and that itself requires a certain level of risk capital, in terms of those who will now look at it from an early stage and take risks to develop the project to a level where it's possible to bring in long-term capital, typically in the form of equity debts and maybe some variants like mezzanine financing. So that process itself has to be financed.

“When you get to that bankability stage, you raise that long-term capital to build. And at some point, those that took that early stage risk to either develop the projects or come in at the greenfield stage, will want to possibly exit or they might want to stay and get yield. So it's important that there's … a secondary market that can help take out that early-stage finance.

“One of the projects Africa50 [has done] is in Benban in Egypt, where you have arguably one of the largest operational solar farms in the world, certainly in Africa. There, we are generating 400MW from six operational solar power plants. One of the ways that we refinanced that project after building it and getting it to stability was to issue a corporate bond in 2022; we raised or refinanced US$335 million.

Source: Rowad Modern Engineering

“So, it shows you that the role of institutions can be critical. I also want to place a very, very important focus, again, on African institutions. It's a really tall order sometimes to raise capital to invest on the continent and there's a lot of constraints – green finance these days, there are certain rules. Does it comply, for example, with the definition of mitigation or adaptation finance? Are we aligned with the Paris agreement? All of these things sometimes can make it very difficult.

“Unfortunately for Africa, sometimes the bulk of that capital rests offshore. So what we're seeing on the continent and what we increasingly hear is the more we can get African institutions themselves taking risk in our own projects, [that will help] de-risk the perception that you can't get things done on the continent.

“[The urgency in] Africa, especially to deal with poverty and other issues like that, is such that we can't wait for any sort of badge type of financing. We need financing, period. And if it means starting with African institutions, we need to move ahead and do that.”

Referring specifically to Lagos state, Odoe said the main issue faced was financing, even for non-green construction schemes.

“Most of the time, you see banks not wanting to fund huge infrastructure projects, only because they feel the state government needs to put a whole lot more in, other than just bringing in the projects to the private sector. [The state government needs] to believe more in the project to the extent that they can provide adequate de-risking instruments that make the project more bankable both for private sector and for the public who is the beneficiary of the project.

Odoe revealed that Lagos state government has been working in partnership with the federal government on the ease of doing business and providing the right enabling environment for investors.

“What this means is there's usually a one-stop shop. For example, the Office of PPP acts as the one-stop shop for a major project. So, when we get proposals for infrastructure projects, we ensure we're able to match it with a particular ministry, department or agency.

“We follow the investor through a handholding process in terms of regulatory permits and approvals, and ensure we're able to, along with the owner ministry, review the project and ensure it is both beneficial to the state as well as the private sector.

“A more recent example would be a huge medical concession project that we've only just initiated here in Lagos state. What we've been able to do, asides bringing in the land, is we've ensured all the regulatory permits and fees are waived in order to ensure the project has a sweetener for the investor as well, because we understand that from a banking and financing perspective, it's not necessarily easy on them in terms of getting the right financing mix, both debt and equity for the project. So we've done as much as we can as Lagos state.

“And it's not just for that medical project alone; we're rolling this out across all our major projects where we see the investors are struggling with the bankability aspect of the project.”

Jordan-Tank highlighted EBRD’s approach of creating national-level facilities that enabled advisory work to be carried out directly with governments and local experts, with dedicated funds for project preparation, PPP advisory and a pipeline of projects pre-vetted with clients.

“These national project preparation facilities are … an improved model from what I think typically has been done by multilateral development banks [in that] they sort of have a very centralised approach where in the headquarters they create a small team of experts and fly in and out of the country,” said the banker. “Over a few decades of work in this area, I'm convinced that working on the ground is much, much better."

Jordan-Tank also emphasised the need to evaluate the revenue generation of projects.

“[When we work with] countries and cities, it's really helping them to build up capacity to raise revenues. So we work very deeply, for example, with cities, with local utilities, thinking about their operational efficiency, revenue generation, tariffs, improving the quality of service in exchange for higher tariffs, done gradually over time.

“We've been able to do this in other countries and there's no secret or different nature to European cities versus anywhere else in the world. They simply got on with the task of creating the revenue that then is the backing for their ability to invest and pay for improved infrastructure.

“So, I think that idea of creating creditworthiness through increased operational efficiency, revenue generation, asset-specific investments, I think that's very key to all of this. And we look forward to trying to bring some of that experience we've had in other places to the new countries we're going to work in.

“And I think it's just such a tremendous moment to be doing this. The world has a lot of chaos. And yet, the places that have the most need and the strongest demographics are places in Sub-Saharan Africa.”

Chamberlain said she anticipated an increase in blended finance structures coming to markets, in particular with the greater focus on carbon mitigation, nature solutions and green financing.

She brought up the example of Kigali's green city pilot, funded concessionally through KfW alongside a private property developer. Chamberlain said that model actually helped reduce the risk of the project and provide commercial returns for the developer to get involved.

Source: Grant Associates

Sustainability assessment methodology

Tokede noted the lack of a globally acclaimed definition for green construction and said the discussion could instead focus on responsible, environmentally conscious practices that can help mitigate and improve environmental performance in the future.

“Particularly in Europe, in the US, we're starting to see an increasing embrace of lifecycle assessment,” said the professor, who is a lifecycle assessment certified practitioner.

“In Australia, the national construction code already incorporates some of these practices as well, making sure … that once there's a particular monetary figure, you are compelled to have your environmental product declarations clearly [specified]. And lifecycle assessment is quite a big one. But, for countries that are struggling, particularly with having such a holistic perspective, embodied carbon is starting to be the low-hanging fruit.

“I would also mention these are not just technical methodologies, but we could also [embed them in] a lot of financial instruments. We can start to use them to benchmark who are those that we're going to be working with and financial institutions. I would say this is where the AfDB may want to take a cue from what we have with the European Central Bank, making sure we're more active in policy and ensuring policy actually guides the development and implementation of green construction projects in Africa.

“Policy is a starting point; if we can get policymakers to be on our side, then we can start to deal with investors, particularly in looking at how they might not necessarily get the sort of returns that they want, but we can start to look at how, for example, investing in sustainable practices can start to give them a competitive edge over some of their rivals.

“For example, we look at people like Dangote, who's the richest man in Africa now, who's [involved] in many [sectors]. We need such big players, for example, to actually start to come clean to us in terms of what their own environmental performance is and how they are investing in it. We're not trying to put such people in the spotlight now, but we're just trying to say that if we start with policy, then we have a better chance to look at some of the biggest players. And I guess this is going to cascade down to some of the mid and low [level players].”

On the issue of enforcing regulations for projects, Odoe said the Lagos state government structures PPPs in a way that builds compliance into the system itself. The government ensures concession agreements and licensing frameworks have embedded regulatory obligations, which mean that if a concessionaire does not meet the standards, it affects their ability to continue to operate or access financing.

In addition, the state has built transparency and monitoring into the system, using periodic reporting, inspections and ensuring those reports are being made public. Moreover, the government has understood that enforcement works best when it is tied to incentives and bankability.

“So, developers and investors know compliance with green regulations, for instance, is not just a box-ticking exercise, it is essentially what unlocks their access to finance, concessional support and a credible place in Lagos state's long-term infrastructure market,” said Odoe.

To round off, Dr Tokede spoke on the importance of education and promoting sustainable construction skills in universities and vocational institutes.

“I think there's a lot of initiatives that are going on, but it's also very important we realise we need to create a product that is being used. At the African Lifecycle Initiative, we realise there's a lot of appetite for us to be able to train people, but one of the things holding it back is looking at how much some of those skills are still attractive within that environment.

“We have to go from the bottom up to ensure people who eventually have sustainable skills have a very important role to play, particularly in our building and our construction sector.”

Oforiokuma opined that while education is important, there is also a need for acculturation, “which is getting people right to the grassroots level to understand that this thing called climate change is real”.

“If we can take it to that level, it then becomes a burning platform and an imperative for all of us as Africa to work together to seek this change.

Host Dr Ogunshakin concluded that while there are numerous opportunities available for green construction in Africa, the need is for innovative solutions to overcome financing challenges.

“The insights shared by our esteemed panelists highlighted the vital role of sustainable construction and uncovered actionable strategies to address financing challenges. It is essential we continue to foster collaboration among all stakeholders to drive meaningful change and create resilient, eco-friendly communities across the continent."

You can watch the full webinar by clicking on the YouTube link below:

Top photo: The green-rated 105 Corlett Drive office building in South Africa (Source: LinkedIn @ Green Building Council South Africa)

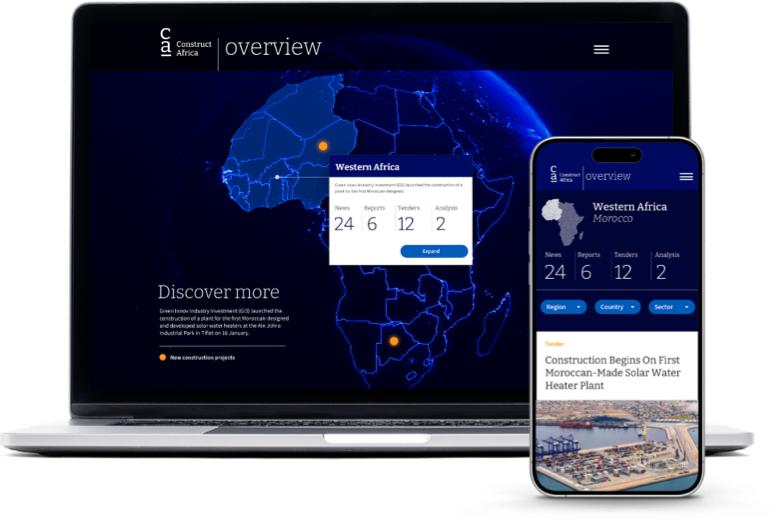

Discover

myConstructAfrica

Your one-stop-shop for information and actionable intelligence on the construction and infrastructure pipeline in African countries

- News, analysis and commentary to keep up-to-date with the construction landscape in Africa.

- Industry Reports providing strategic competitive intelligence on construction markets in African countries for analysts and decision-makers.

- Pipeline Platform tracking construction and infrastructure project opportunities across Africa from conception to completion.

- Access to contact details of developers, contractors, and consultants on construction projects in Africa.

- News and analysis on construction in Africa.

- Industry Reports on construction markets in African countries.

- Pipeline platform tracking construction and infrastructure projects in Africa.

- Access to contact details on construction projects in Africa.