African Corporates Get Serious About Climate Change

FreeFirms in the region are ahead of other regions in proactively identifying and measuring climate risks.

African companies are leading the pack in climate risk assessment, adaptation and value creation, according to an annual climate survey report by the US’ Boston Consulting Group (BCG) and sustainability action platform CO2 AI.

Titled ‘How Companies are Tackling the Climate Challenge – and Creating Value’, the report analysed responses from 1,924 executives responsible for their company’s emissions measurement, reporting and reduction initiatives. The firms stem from 16 major industries and 26 countries, and are collectively responsible for 40% of global greenhouse gas (GHG) emissions.

The survey found that while reporting is down from 9% in 2024 and 10% in 2023 globally, African companies, at 14%, are above the survey average in terms of identifying and measuring both physical and transition climate risks, and second regionally, after Asia-Pacific (16%). Moreover, African countries have been assessed to be the most likely to assess climate risks – especially physical climate risks – since the continent is expected to be disproportionately impacted by climate change.

On the ground

In real terms, Africa is already being ravaged by the effects of climate change.

According to the August 2024 Africa Climate Security Risk Assessment (ACRA) report by the multilateral initiative Weathering Risk, while the continent is one of the lowest contributors to GHG emissions, it is highly vulnerable to the impacts of climate change due to the intersection of various socioeconomic, political and environmental challenges. The climate crisis has already caused significant harm to biodiversity, water security, food production, life, health and economic growth, and climate change impacts are projected to worsen significantly over the coming decades.

Today, 1.34 billion Africans experience water insecurity, 20% of Africa’s population are affected by hunger, and access to cheap and reliable energy is often lacking, said the ACRA report, citing 2023 figures from the UN’s Food and Agriculture Organisation (FAO).

The BCG and CO2 AI survey found that Asia-Pacific, the Middle East and Africa saw the highest increase in climate loss normalised as a percentage of revenue, with average climate-related loss in Africa increasing by 0.2% from 1.9% in 2023 to 2.1% in 2024.

There is a strong local awareness, the report states, that climate change poses significant risks to business operations and many companies are already experiencing its effects. As a result, firms in the region are taking a more proactive approach to comprehensively identifying and measuring these risks, placing them ahead of other regions.

“African businesses are leading by example, with 14% comprehensively measuring climate risks which is well above the global average,” said Hamid Maher, managing director and senior partner of BCG’s Casablanca division. “This is a testament to the continent’s commitment to resilience and forward-thinking leadership, both of which are vital as Africa faces disproportionate climate impacts, yet also shows remarkable resourcefulness.”

However, African firms do have ground to cover, according to the survey. Only 6% of large African companies comprehensively measure emissions, compared to 7% globally, while just 10% of African businesses have set emissions targets that cover scopes 1, 2 and 3 – three percentage points below the global average.

African corporates are broadly aligned with global peers in terms of emissions transparency, but fewer have set explicit targets to reduce those emissions, says the report, adding this suggests that while disclosure may be driven by external requirements from other jurisdictions or customers, there is comparatively less emphasis on decarbonisation relative to the rest of the world.

Climate returns

According to the survey, 82% of the global companies surveyed say they have captured economic benefits from decarbonisation, with 6% reporting a value that exceeds 10% of annual revenue; that is, a net value (after accounting for costs) of US$221 million per firm. These benefits are largely driven by revenue growth from sustainable products and operational savings from efficiency gains and resource optimisation.

The report found that African companies lead in capturing significant benefits from decarbonisation (11% of companies versus the survey average of 6%) and adaptation (7% of companies versus the survey average of 4%). Their investments in climate action are seen as yielding tangible benefits, strengthening their position as reliable suppliers and generating greater value for their businesses.

Among global firms that assess both physical risks such as storms and rising seas, and transition risks including policy and market shifts, the average projected financial exposure by 2030 is US$790 million. Nearly half of the companies report that their climate risk adaptation efforts generate a return on investment of more than 10%, demonstrating that proactive preparation delivers real and measurable value.

Advanced tools

The survey states that as firms scale up their climate investments and goals, they are also strengthening how they finance and operationalise climate action and increasing their use of advanced governance mechanisms. One-third of companies have been found to have implemented internal carbon prices and adoption of climate transition plans has risen 5 percentage points year-over-year, with 61% of plans now approved at the board level. These tools, the report says, represent an important shift as corporates are transitioning from broad aspirations to more operationalised climate strategies.

By making sustainability central to strategy, the survey says a small group of firms is realising financial benefits worth roughly 10% of their revenue. It identifies four common enablers among corporates that are generating the most financial value from climate action:

· Comprehensive emissions and risk measurement (1.4x more likely to achieve significant revenue)

· Quantification of impact through internal carbon pricing and risk modelling (1.6x)

· Adoption of transition and adaptation plans (2.2x)

· Use of multiple advanced digital solutions (2.3x)

Specifically, African companies are using several advanced digital tools for mitigation: generative AI (60%); AI agents (54%); predictive AI (48%); advanced computing (40%); Internet of Things (IoT; 36%); and augmented reality (AR)/virtual reality (VR; 34%).

Additionally, they are using the following technology for adaptation and resilience: generative AI (56%); AI agents (49%); predictive AI (46%); advanced computing (38%); IoT (37%); AR/VR (29%); earth observation (23%) and drones (19%).

“The companies that are really getting value from sustainability are the ones leaning into AI and advanced digital tools," says Charlotte Degot, CO2 AI’s CEO and co-author of the report. "They’re using them over 10% more than their peers, especially to drive decarbonisation. And when companies layer multiple advanced solutions, they’re more than twice as likely to achieve real, significant benefits.”

Top photo: Climate change (© Nitsuki | Dreamstime.com)

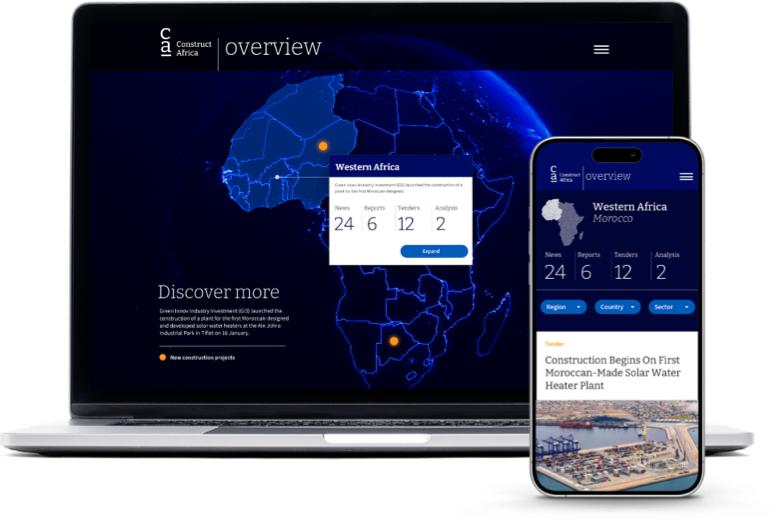

Discover

myConstructAfrica

Your one-stop-shop for information and actionable intelligence on the construction and infrastructure pipeline in African countries

- News, analysis and commentary to keep up-to-date with the construction landscape in Africa.

- Industry Reports providing strategic competitive intelligence on construction markets in African countries for analysts and decision-makers.

- Pipeline Platform tracking construction and infrastructure project opportunities across Africa from conception to completion.

- Access to contact details of developers, contractors, and consultants on construction projects in Africa.

- News and analysis on construction in Africa.

- Industry Reports on construction markets in African countries.

- Pipeline platform tracking construction and infrastructure projects in Africa.

- Access to contact details on construction projects in Africa.