From Blueprint to Execution: Tokenising Infrastructure

Innovative Financial Instrument for Infrastructure Investment

The Road from Concept to Capital

In the last article, I explored how infrastructure tokenisation could address a long-standing challenge: the liquidity problem. We considered the structural hurdles in traditional infrastructure investment, and the ways blockchain may offer a new path forward, particularly in unlocking capital from a broader and more diverse investor base. Now, we move from principle to practice.

If tokenisation is to shift from theory into a credible investment mechanism, it must first pass through familiar territory: the financial instruments that underpin capital flows. This article begins to unpack two such pathways: the use of tokenised bonds to offer indirect exposure to infrastructure assets, and the direct tokenisation of those assets themselves.

Both approaches present opportunities. But they also raise important questions around structure, regulation, and execution.

Infrastructure Bonds Reimagined

Bonds have long been the workhorse of infrastructure finance. Trusted for their predictability, valued for their alignment with long term goals. But conventional bonds come with baggage. They tie up capital for years and offer little room for manoeuvre once issued. This is where the door opens.

Tokenisation introduces a new class of infrastructure bonds. These are not just digital versions of what already exists. They are intelligent, programmable assets that represent claims on future cash flows. More importantly, they can be fractionalised, opening access to a broader range of investors. From sovereign wealth funds and development banks to retail investors and diaspora communities, the gates are lifting. Regulated platforms and compliant digital markets are making participation possible in ways that were once out of reach.

The bond itself becomes dynamic. Powered by blockchain, these instruments gain new capabilities. Coupon payments are automated. Compliance is embedded in the code. Every transaction is recorded in real time and visible to all relevant parties. The result is a structure that moves with precision. It is faster, more efficient, and entirely transparent.

This is no longer a distant concept. Traditional finance is already moving. EIX Global, working with Aquis Exchange, are deploying private placement bonds to finance infrastructure projects through a functioning secondary market. Their use of repayment guarantees and institutional structuring shows that the market is evolving. But tokenised bonds are not just an evolution. They are a redesign from the ground up.

They eliminate the friction. There is no need for manual reconciliations. No dependency on custodians or clearing services. Smart contracts allow issuance, trading, and settlement to take place on a single, seamless digital track. What used to take days can now happen in moments, with trust encoded and execution automatic.

Tokenised bonds can also adapt. Coupon rates can respond to sustainability milestones or project benchmarks. Transfers can be restricted to verified investors in real time, based on embedded compliance logic. They open the door. Not just to sovereign players, but to everyday investors, community treasuries, and purpose driven capital. With live reporting and transparent audit trails, trust is not built through paperwork. It is built into the blockchain protocol.

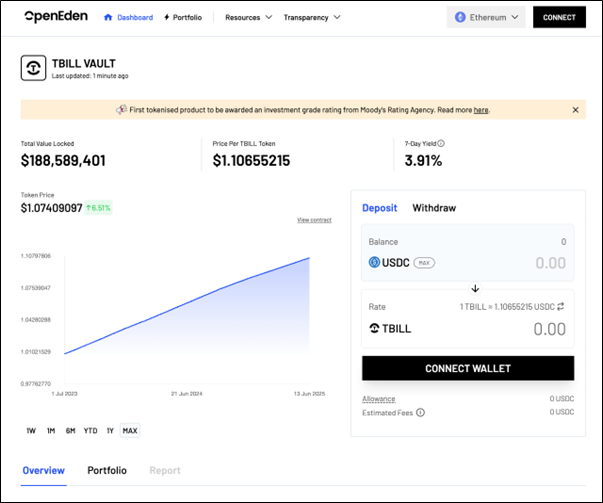

We are already seeing this momentum take shape. Platforms like OpenEden are carving out a space in tokenised Real World Assets with the launch of their MOODY’s rated investment grade treasury fund. Their model echoes what tokenisation makes possible: efficiency, accessibility, and a streamlined user experience. The financial instrument itself begins to evolve. What emerges is not an upgrade. It is a new language. One that speaks in executable code, not static agreements. One that prioritises access over exclusivity. One that brings infrastructure closer to the people it serves.

This is not just a pivot in financial architecture. It is the first step in reimagining how we fund the physical world.

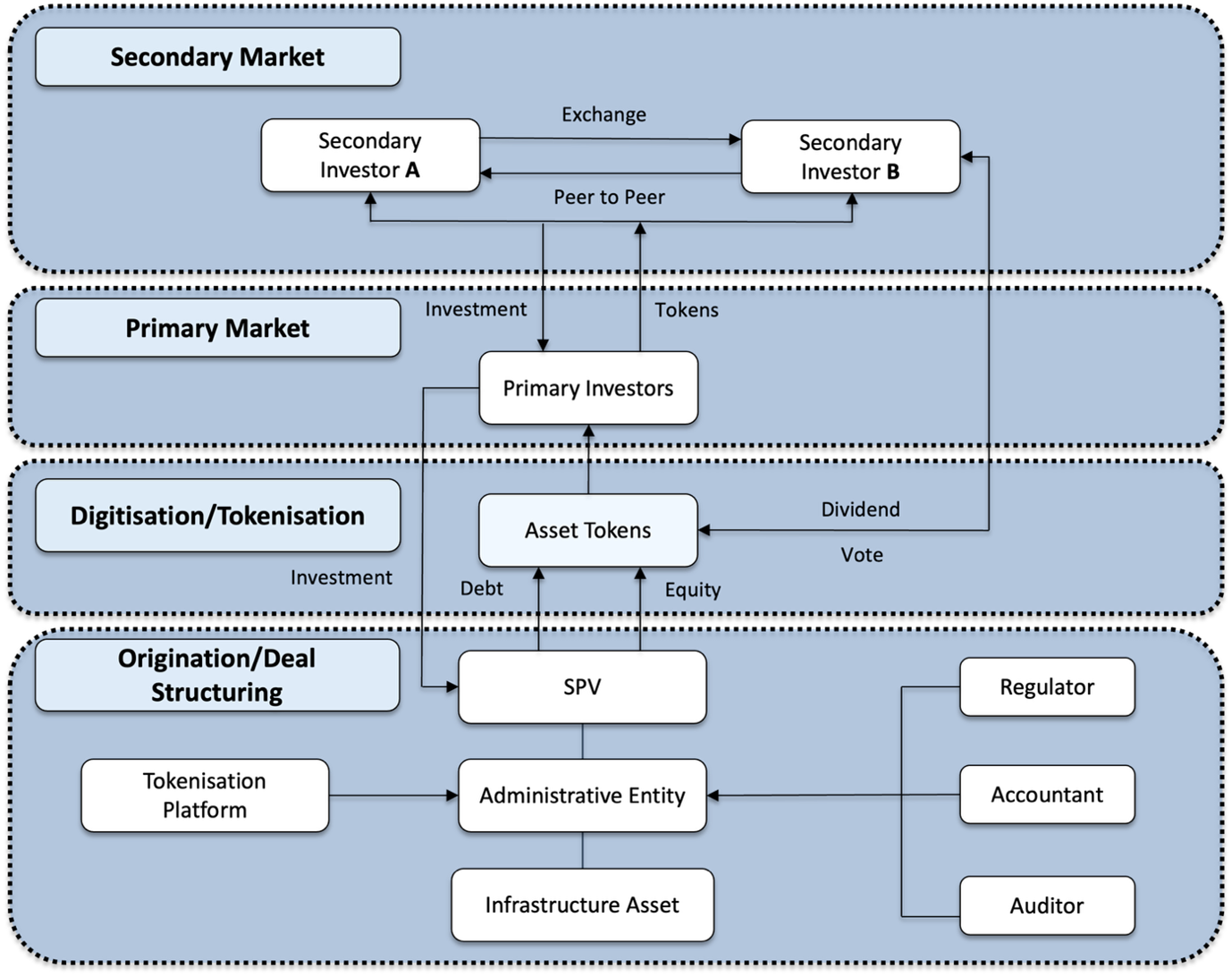

Tokenising the Asset Itself

While bonds offer indirect exposure, direct tokenisation takes a more radical step: dividing the ownership of the infrastructure asset into digital tokens that can be bought and sold. This approach brings infrastructure into the realm of asset backed securities, where token holders might gain rights to a share of revenues, governance, or even future equity value.

What once required deep pockets and institutional access could now be opened through compliant, peer to peer digital platforms. In effect, infrastructure begins to operate more like a public market instrument, with all the associated transparency, traceability, and accessibility that blockchain provides.

But this route also raises new challenges. Who governs the platform? What rights do token holders have? And how do we structure such investments in ways that align public value with private capital?

Secondary Markets and the Liquidity Question

Whether through bonds or direct asset tokens, the key test remains: can we enable true liquidity?

Secondary markets are the mechanism by which capital remains mobile. Without them, tokenisation risks becoming just another layer of complexity. With them, it becomes a tool for dynamic participation, allowing investors to enter and exit positions more freely, price discovery to occur transparently, and projects to remain attractive over longer horizons.

This is not just about creating an app to buy and sell tokens. It is about building regulatory clarity, credible custodianship, and interoperability between digital asset platforms and traditional finance. The moment secondary markets become stable and trusted, the capital will follow.

Looking Ahead: From Innovation to Integration

The financial mechanisms discussed here are not futuristic abstractions. They are grounded in established principles of project finance and capital markets, simply reimagined through a new technological lens.

The challenge ahead lies in integration. For tokenisation to scale, we need alignment between developers, regulators, investors, and technologists. We need sandboxes, testbeds, and bold first movers willing to pilot real infrastructure projects with tokenised models.

Africa, with its young demographic, digital appetite, and infrastructure needs, stands at a unique intersection. The opportunity to leapfrog legacy systems is real. But doing so will require not just the tools, it will require the trust, talent, and tenacity to see them through.

In the next article, I will begin to map out how such financial structures could be designed in practice, drawing from recent case studies, regulatory pilots, and lessons from adjacent sectors. Because the question is no longer whether infrastructure can be tokenised, it is how, and how soon.

Top Photo: Smart City Digital Network (Setan Cell / Dreamstime)

Tunde Ogunshakin is a seasoned infrastructure investment professional with expertise in corporate finance, asset management, and blockchain applications in the built environment. As Director at AEO Group, he leads global strategic infrastructure projects. Tunde continues to advance industry discussions through research on latest innovative developments, positioning himself as a rising thought leader in innovation within the built environment.